Dreana A.

Bizee is the best! Professional & always available to answer all my questions. I'm so grateful.

Services

Filing an Annual Report Is Required by Your Secretary of State — For All Business Entities

Lighten your workload and ensure your business stays compliant by letting Bizee handle your annual report filing.

Join 1,000,000+ Entrepreneurs like you

Entrepreneurship is booming – and we're happy to be one of America's fastest growing companies.

An annual report is a filing that provides details of your company's business activities over the previous year. Some states call annual reports for LLCs “Statements of Information.”

Annual reports give state governing authorities important information, including the names and addresses of directors or managing members of a corporation or LLC, as well as the company and Registered Agent address.

As a business manager, director or owner, you’re obliged to follow state regulations and meet certain requirements, one of which is to file an annual report for your LLC or corporation.

Some states only require you to file a report every two years, called a “biennial report.”

A formal annual report is required to be filed with your Secretary of State. Learn more about filing an annual report in our ultimate guide.

You may also need to create additional yearly reports for your investors, shareholders or stakeholders, but these business or financial reports are not the same as LLC or corporation annual reports.

If you’ve incorporated a business — as an LLC, LLP, S Corp, or C Corp — you must file an annual report (or equivalent report based on your state's schedule), normally with your Secretary of State. This applies no matter how big or small your business is.

Annual reports can be daunting and filing incorrectly (or not at all) can cause serious headaches and consequences later, such as late penalties, dissolution and loss of liability protection.

Avoid tiresome paperwork and the repercussions of noncompliance by letting Bizee take care of the paperwork for you. Free up your time to focus on what matters — your business.

Generally, sole proprietors and partnerships don’t have to file an annual report because the business is not a separate entity from the business owner.

Annual reports vary in complexity and typically include the following:

The purpose of an annual report is to keep your state informed of your business’s activities throughout the previous year and declare any changes to the details or ownership of your business — for example, if the business has changed locations or has new directors or managers.

Annual reports also provide shareholders and any other interested people with information about your business’s financial performance.

Need to make changes to your business outside of the usual annual reporting time? No problem! You can file an Articles of Amendment form or have Bizee take care of it for you.

If you don’t file your annual report or miss the deadline, you put your business at risk. Your state could impose a late penalty fine and your business could lose its “good standing.”

Further delaying filing means your business could be dissolved by your state agency and struck off the register. If this happens, you’ll no longer have liability protection and can’t continue as an LLC or corporation.

If you need to file an annual report for your LLC or corporation, you can normally do so online through your state’s website.

In addition to filing your annual report, you’ll also need to pay a fee — these fees vary from state to state and could range between $50 and $400.

Some states will also require you to file other business documentation if important details of your business have changed.

In some states, annual reports need to be filed on a predetermined date for all entities regardless of the date of formation. Other states require the annual report to be filed on the anniversary date of formation.

The due dates for LLC and corporation annual reports vary from state to state. You can find your filing date on your state’s website.

In addition to formally filing a corporate annual report, you may also need to produce business and financial reports for investors, directors, managers and other stakeholders.

Although there aren’t any “legal” requirements for what these reports should contain, there are certain conventions for what’s included.

Businesses exist to make a profit, so finances are usually at the forefront of business annual reports.

Whether you’re filing a formal annual report for your LLC, S Corp or

C Corp, or you’re creating other business and financial reports, it’s important to ensure that you understand exactly what’s required from you.

Bizee is the expert at making sure annual reports are perfect. Save yourself the time and effort of preparing and filing your annual report, and let us take care of things.

Save the stress and free up time while avoiding missed deadlines, state fines and the risk of dissolution. Let Bizee handle your paperwork.

Place your order below and an Bizee representative will contact you to get the specific information required to complete and file the annual report in your state of formation.

Exceptional Value for Your Money, Always

No subscriptions, no recurring fees and no hidden costs. Clear, transparent pricing — every time.

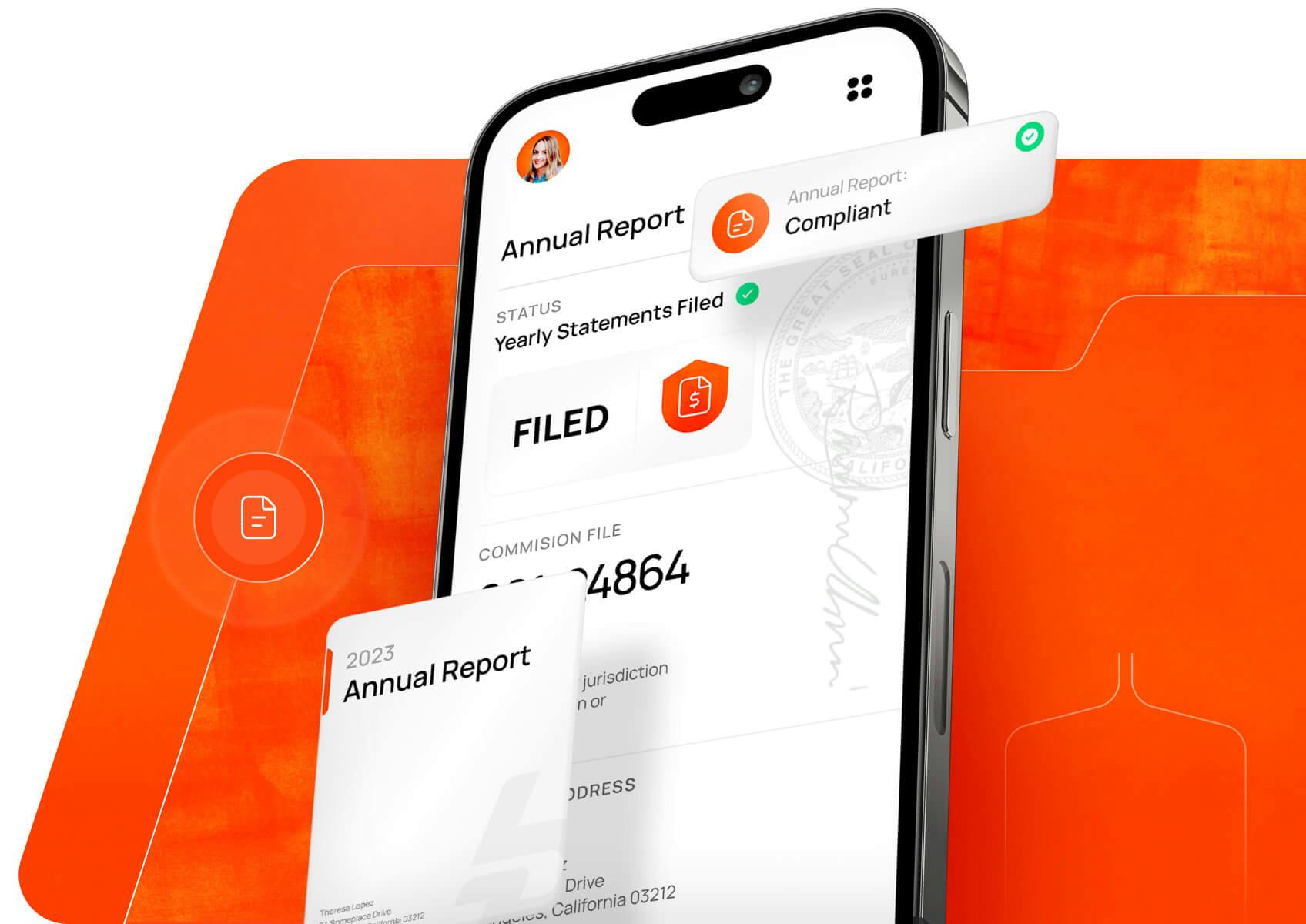

Enjoy a Superior and Modern User Experience

File your annual report effortlessly. A carefully crafted experience makes entrepreneurship easy.

Personalized, Industry-Leading Support

24/7 fast and friendly customer service. Talk to a dedicated specialist, not a salesperson, whenever you need to.

Bizee is the best! Professional & always available to answer all my questions. I'm so grateful.

Bizee has been great to work with. Their prices are reasonable and they exceed expectations

Easy, smooth, one of the best business decisions I’ve ever made, was to utilize Bizee