Services

Services

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

W hen you run your own business, navigating the IRS' tax regulations can be a headache. And when your shares hit the stock market, you'll need to deal with the U.S. Securities and Exchange Commission (SEC) as well.

If you've been researching the forms you need to file as the owner of a business with publicly traded stock, you've likely seen forms 10-K and 20-F mentioned. But what is the difference between 20-F vs. 10-K, and are you required to file either one? You'll find the answers to your questions (and save yourself another hassle) up ahead.

Sign up for our Annual Report Filing Service.

Get Started

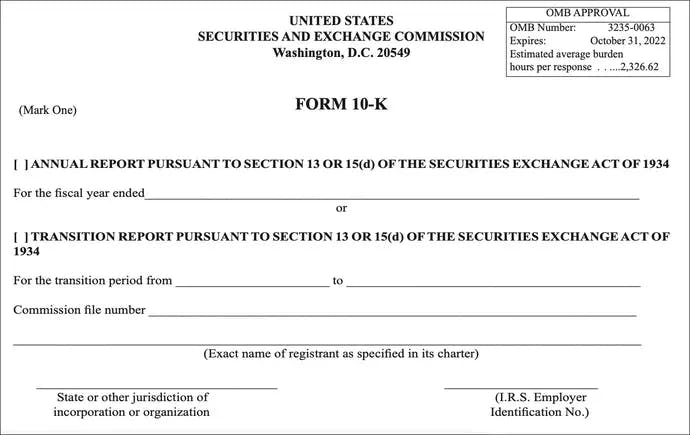

First thing's first, what exactly is a 10-K filing anyway? In short, it's a form that U.S.-based public companies need to submit to the SEC on a yearly basis when filing their annual reports.

A business can also use Form 10-K to file a transition report when changing the end date of its fiscal year.

But what's in Form 10-K? As the SEC itself explains :

Form 10-K provides a comprehensive overview of the company's business and financial condition and includes audited financial statements.

The deadline for filing Form 10-K depends on how much money your company makes. Once your fiscal year ends:

Note that Form 10-K is different than the annual report to shareholders and typically contains more in-depth financial information. For instance, in addition to many other details, your 10-K form will need to include your company's:

By filing Form 10-K, you'll be giving the SEC a detailed view of your company's performance, evolution and expenses for the most recent fiscal year. And even though you'll be sending Form 10-K to the SEC alone, it will be also be made available to the public.

Want to see real examples of other companies' 10-K filings? Head to the SEC's EDGAR database , search for any publicly traded company you'd like, open the company's profile, and click "10-K (annual reports)" under the "Selected Filings" section.

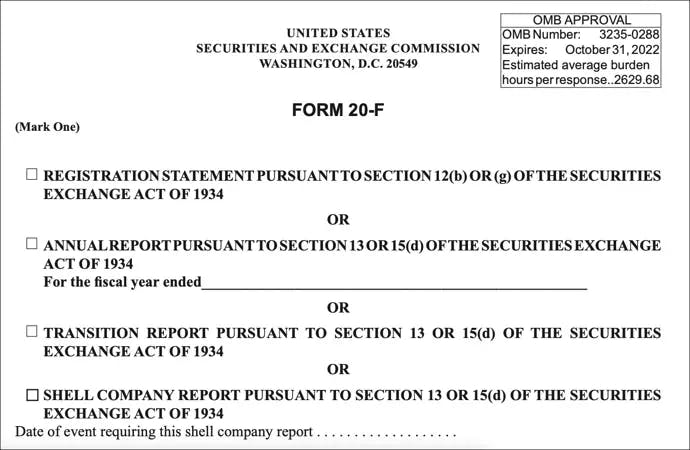

If a foreign company decides to list its equity shares on U.S. exchanges, then it will need to file Form 20-F with the SEC.

If your company is based outside the U.S., then you can use Form 20-F when:

When filing Form 20-F, you can expect to provide plenty of information about your company's finances, involved parties and organization. For example:

By filing Form 20-F, you'll be allowing the SEC to understand your company and the securities it's selling (or intending to sell) on U.S. exchanges.

And just as with Form 10-K, all 20-F filings are available to the public via the SEC's EDGAR database.

You might have a clearer idea of what Forms 20-F and 10-K are, but what's the difference between the two and which one should you file?

Here's what it boils down to:

As such:

But knowing which of the two forms you need to file is just the beginning — next, you'll need to actually gather, organize and submit the large scope of information they demand.

And whether your company is based in the U.S. or not, it won't be a one-and-done deal. Rather, you'll have to do so every year for as long as your company's securities remain on the U.S. stock market.

If you want to simplify the process, ensure accuracy and save time, Bizee's experts can help you complete and file your annual report .

Sign up for our Annual Report Filing Service.

Get Started

Carrie Buchholz-Powers is a Colorado-based writer who’s been creating content since 2013. From digital marketing to ecommerce to land conservation, she has experience in a wide range of fields and loves learning about them all. Carrie is fond of history, animals and beauty in equal measure. In her free time, she enjoys knitting, playing video games and exploring Colorado's prairies and mountains with her husband. Read more

Get Bizee Podcast

Join us as we celebrate entrepreneurship and tackle the very real issues of failure, fear and the psychology of success. Each episode is an adventure.