Services

Services

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

I f you’re a business owner who is deciding to close your business and stop business operations for your LLC, you might wonder what happens to your 401(k), SEP IRA or other retirement savings accounts that you might have through the business. The good news to know up front is that, even if your LLC is closing, your 401(k) investments are most likely to remain safe, separate and unaffected by the business’s closing.

If you have a company 401(k) or other retirement savings plan , that money is generally considered to be separate from the business’s funds. You have a variety of options to keep your retirement investments safe, and with most of these options, you can continue contributing to your retirement account.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File Dissolution

If your company is closing, you have a few options for what to do with your 401(k):

Roll over your 401(k) into a Rollover IRA. You can choose two options:

Let’s take a deeper dive into the options available to you with regard to your 401(k) when your LLC closes.

This is an easy option to choose if your funds are already invested with a third-party retirement plan administrator, such as Fidelity Investments, AIG, Principal Financial Group, Mutual of Omaha, Vanguard or others on the market. While you won’t be able to continue making contributions to your 401(k) once your business closes, your investments will stay invested, your account will still exist under your name and your retirement savings can continue to grow while you deal with the other facets of closing down your business.

Once you are prepared to begin making retirement contributions again, you can decide on your next steps of getting your 401(k) transferred or rolled over, or you can start a new retirement savings account depending on your new employer and overall financial planning circumstances.

If you plan to start a new job with a different company once your LLC closes, you can transfer your balance to a new account with your new employer’s 401(k) plan administrator.

However, before you transfer to the new company’s plan, do some research:

Transferring your 401(k) to a new employer’s plan can be a convenient option as it will consolidate your old and new 401(k) balances into a single account, making it easy for you to keep track of where your investments are.

There are two ways to transfer your balance to the new 401(k):

Once your LLC has closed, you can transfer your 401(k) retirement account from the plan administrator to a traditional or Roth IRA account. Making this kind of transfer is called a rollover. Since you are doing a direct transfer from one retirement account to another, no taxes are due at the time of transfer as long as you don’t take a cash disbursement or withdrawal along with the transfer.

You might want to choose to roll over into a traditional IRA account if your 401(k) account contains pre-tax contributions. Or if your retirement savings are already in a Roth 401(k) (with post-tax dollars), a Roth IRA transfer might be a better fit as future Roth IRA contributions will also be after-tax.

Or if you’re willing to owe extra taxes this year in exchange for tax-free income in the future, you can convert your pre-tax retirement savings into post-tax Roth IRA savings. Unlike traditional IRA or traditional 401(k) funds that are taxable income in retirement, Roth IRA accounts provide tax-free income in retirement. So for some people, it can be a better deal in the long run to convert 401(k) or traditional IRA funds to a Roth. However, the Roth conversion can be complicated, and it is not the right answer for everyone; consult with a financial adviser or tax professional before you decide to do this.

Similar to transferring your 401(k) to a new plan, the rollover option will also be performed as either a direct transfer or by the plan administrator mailing you a check that must be deposited with the new custodian within 60 days. Again, make sure to deposit the check promptly! If the check is not deposited within the 60-day timeframe, this will be treated as a taxable distribution from your retirement account, and you will be subject to any taxes and penalties that come along with it.

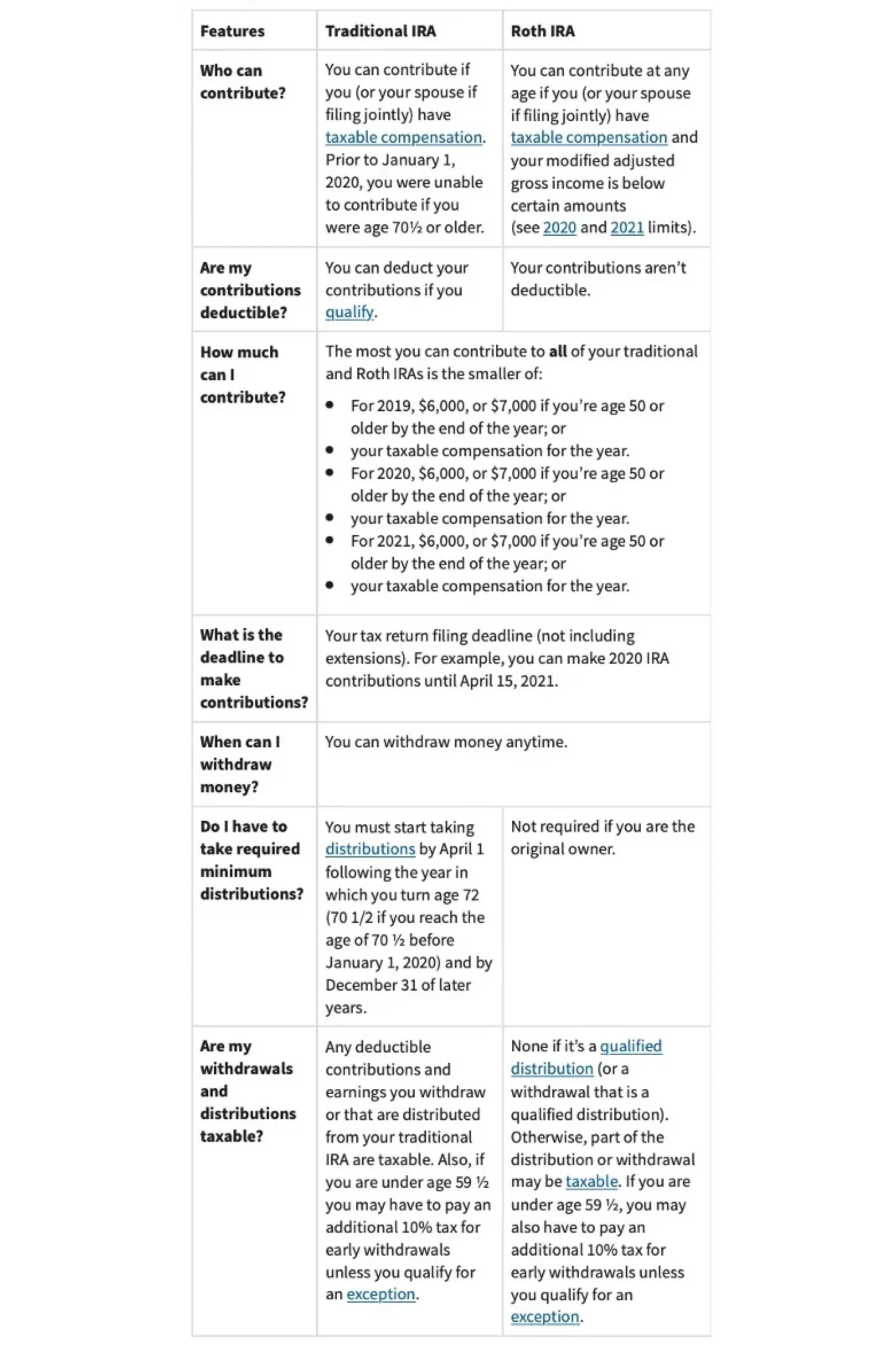

Both traditional and Roth IRA accounts allow you to save for retirement, but in different ways when it comes to where you find the tax advantage. This chart highlights how traditional and Roth IRAs are similar and how they differ:

Closing your LLC can be a stressful time both logistically and mentally. Having a plan for your retirement account will take some of the financial burden off of your shoulders. Keep in mind that if you just aren’t sure what to do with your retirement funds right now, you can absolutely keep your 401(k) account as-is with the current plan administrator as long as they are open to maintaining your account.

This will give you a little time to deal with other needs before attending to your retirement account plans. Before deciding between a rollover or cash disbursement, consider tax and penalty implications. Whatever comes next in your career, hopefully you can leave your retirement money invested and let it keep growing for the future. Closing an LLC is one chapter of your life, but there are many more to come.

Let Us Handle Your Business Dissolution Paperwork — So You Can Get Started On Your Next Great Idea.

File Dissolution

Ben Gran is a freelance writer from Des Moines, Iowa. Ben has written for Fortune 500 companies, the Governor of Iowa (who now serves as U.S. Secretary of Agriculture), the U.S. Secretary of the Navy, and many corporate clients. He writes about entrepreneurship, technology, food and other areas of great personal interest. Read more

Get Bizee Podcast

Join us as we celebrate entrepreneurship and tackle the very real issues of failure, fear and the psychology of success. Each episode is an adventure.