Every year, businesses are required to fill out an annual report along with their taxes. This paperwork confirms that your business is active and operating in a legal manner. Below, we'll go over everything you need to know about annual reports, including details for every state.

Annual Report Filing: Simplify Compliance for Your Business.

Sign up for our Annual Report Filing Service.

Get Started

State-by-State Annual Report Filing Information

Our comprehensive list has information on filing an annual report in all 50 states for LLCs and corporations. To access due dates, filing fees, and info on filing frequency, select your state from the drop-down below:

What’s an Annual Report?

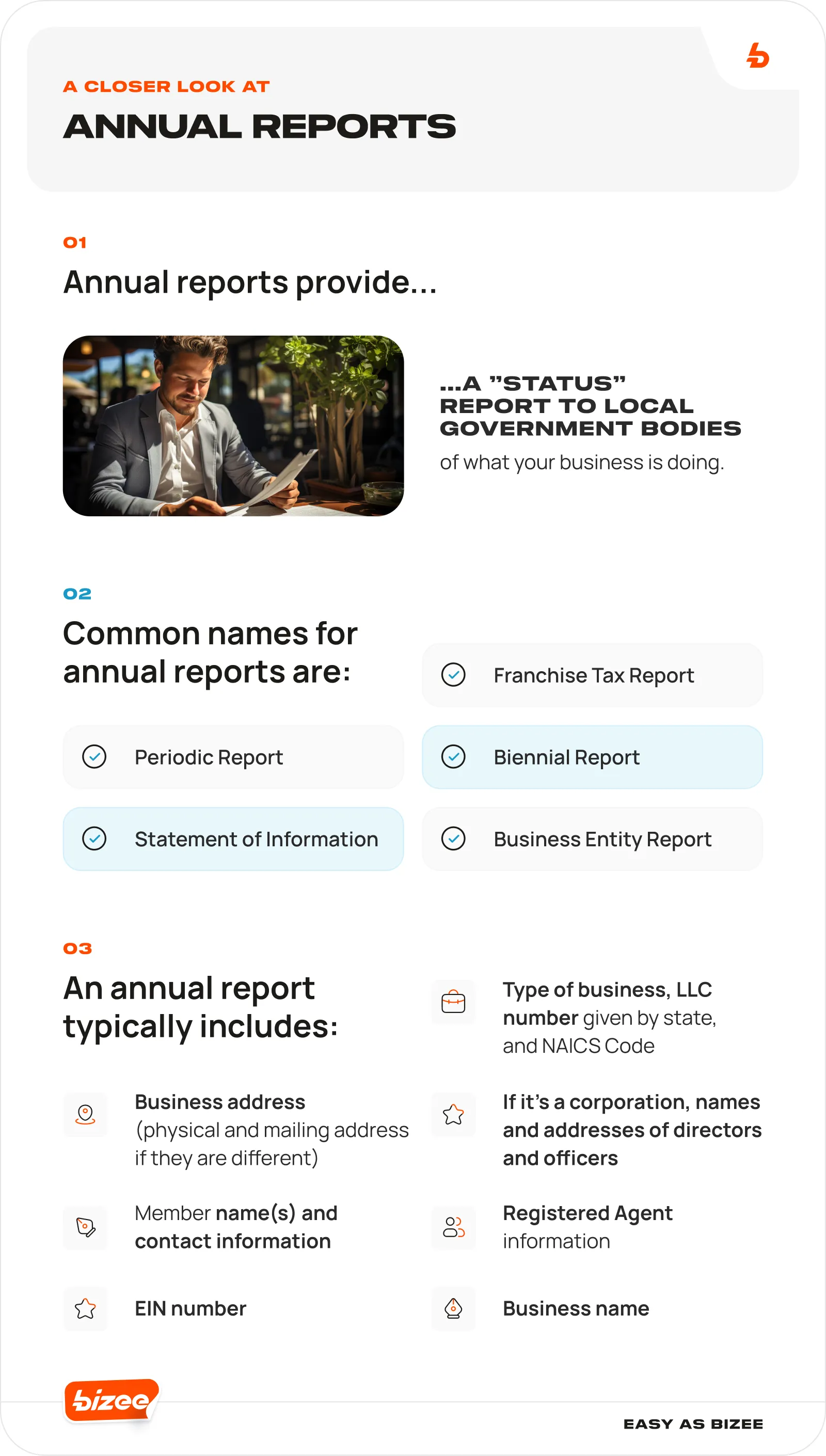

An annual report, often known as a Statement of Information or Periodic Report, is a filing that business entities, like LLCs, Corps or S Corps, have to do with their respective Secretary of State. Sole proprietors or partnerships aren't generally required to file one.

The purpose of the annual report is to provide investors, government bodies, and the public with important information to locate and communicate with businesses formed or operating within the state.

Annual report filing provides insights into your business’s activities and dealings in the previous year. Think of it as an up-to-date report card for your company.

An annual report is generally comprised of important details pertaining to your LLC, such as:

- Business name

- Member name(s) and contact information

- Business address (physical and mailing address if they are different)

- Type of business and NAICS Code

- Registered Agent information

- If it’s a corporation, the names and addresses of directors and officers

The information has to be accurate and factual. Doctored-up or false information can result in unnecessary fines or even be considered fraud.

Some states may require additional information, but remember that these requirements can change unannounced. Always check with your Secretary of State’s website for the latest filing information.

Why Should I File an Annual Report?

All businesses must file an annual report in order to avoid penalties. Failure to file or missing the deadline can result in fines or loss of your Certificate of Good Standing. Failing to file for years in a row can result in your company's dissolution.

Filing your annual report also shows the regulatory authorities that your business is still "current" and operational. It helps you keep your business name, trademarks , and relevant tax and liability advantages.

Steps to Filing an Annual Report

The steps to filing your annual report are based on your state of incorporation and entity type. Your Secretary of State website will provide you with a form and online portal to submit your information. However, there are a few things you should watch out for and check regularly:

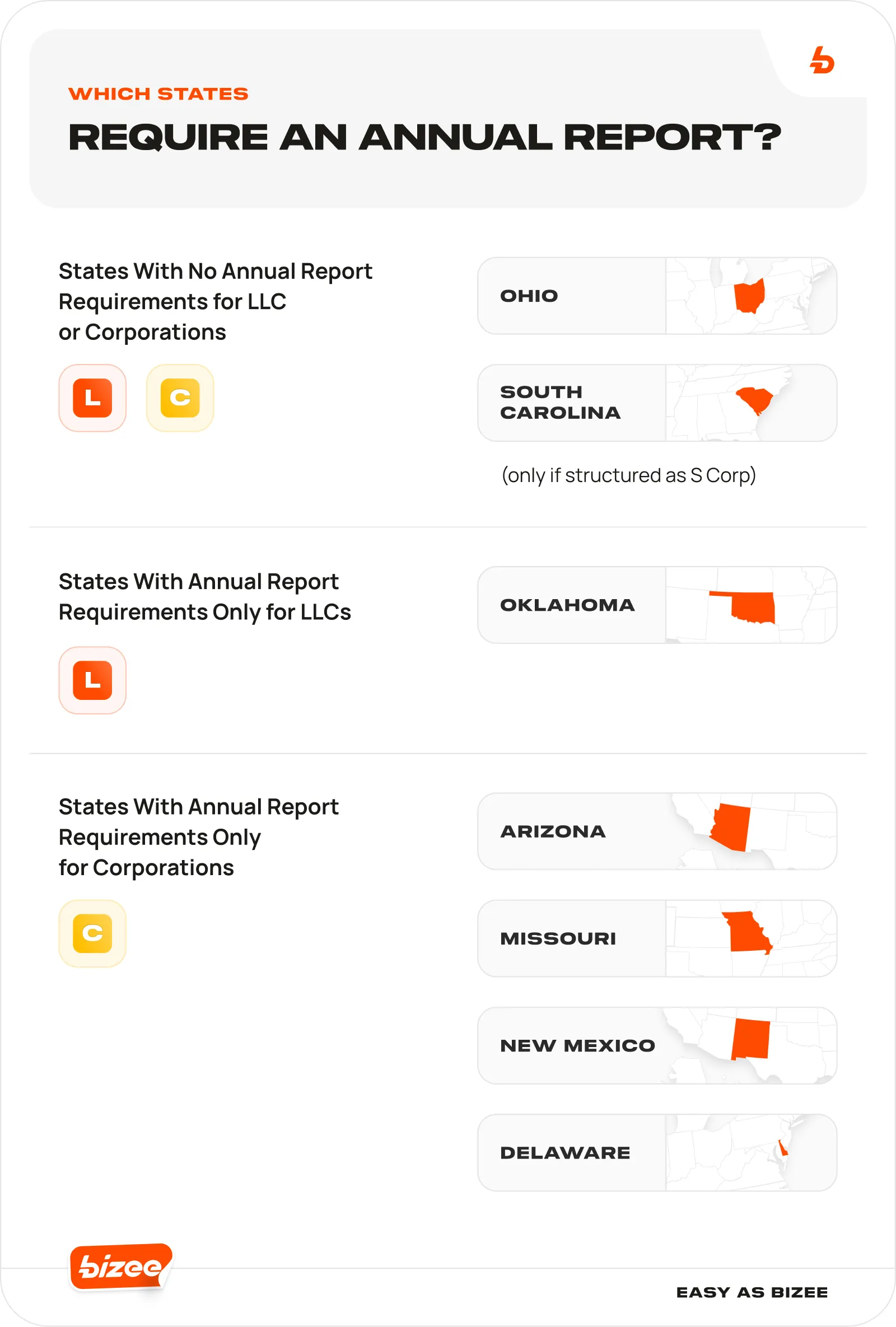

- Which States Require an Annual Report? Not all states require annual report filing. For example, Ohio and South Carolina don’t require any annual report filing for LLCs or corporations. Missouri and New Mexico only require annual report filing for businesses structured as a corporation.

- Filing Dates . Each state has a different stipulation on the annual report filing due date . Some require the first report within six months of incorporation. Others require it to be submitted biennially (every 2 years).

- Filing Procedure . Times have changed, and though some states still accept annual reports by mail, the majority of states only accept electronic filing. There might be some payment differences for mail-in versus online applications.

- Fees . Filing an annual report isn’t free of cost and there is no standard fee for annual reports. All states (except Idaho) charge a fee for processing for-profit Corporation and LLC paperwork. The filing fees could range from $10 to $300 — all depending on your business's home state.

Let's say you're running a business in Newark. You might be wondering, "How do I file a New Jersey annual report?" Or, maybe you're a freelancer working out of your home in Dallas wondering, "Are annual reports required in Texas?" Our state-by-state search tool above provides annual report filing requirements, fees, and deadlines to help you avoid digging through your Secretary of State’s website.

A Must-Do: Filing Your Annual Report

Most states are required to file an annual report during tax season. If you are stretched for time or confused about how to file your annual report, Bizee’s Annual Report service can manage all the paperwork for you, keeping you in good standing with your state.

Annual Report Filing: Simplify Compliance for Your Business.

Sign up for our Annual Report Filing Service.

Get Started