T he business landscape in America and across the world has significantly changed in 2020. The United States has moved from having one of the strongest global economies to struggling with massive unemployment and industry disruptions across the country.

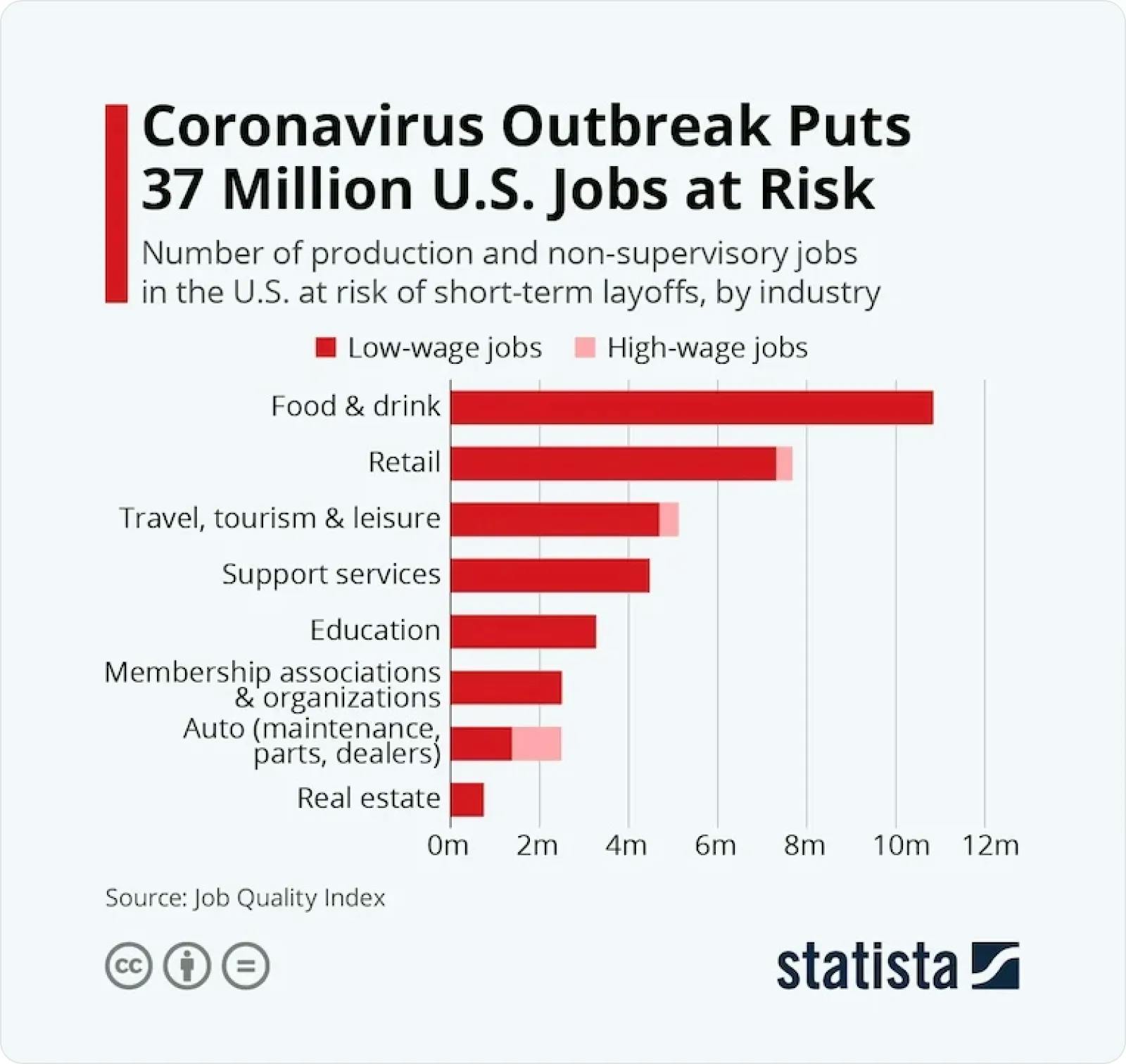

On April 3, 2020, the U.S Bureau of Labor Statistics reported an unemployment rate of 4.4 percent , spiking up from 3.5 percent just the week before. Tens of thousands of businesses have closed due to the coronavirus, forcing millions to look for new work. Job security is on everyone’s mind.

For the recently furloughed, underemployed and unemployed, many are considering shifting gears and working as freelancers or starting their own business with the hopes that the tide will turn and America will get back to “life as usual” soon.

Virtual Mailbox Setup: Secure and Professional Mail Management.

Get Started with Bizee’s Virtual Address Service.

Sign Up Now

Opportunities in Creating a Remote Business

Millions of people stuck at home may have recently lost a job. If you are one of them, now is the ideal time to follow your dream and start a home business. Opportunities in establishing a remote business are growing, especially during this time of social distancing when people still need to remain connected.

Schools across the country are closed and may remain closed for the rest of the year. Parents are no longer commuting to the office, but are now working from home with little time to homeschool. This presents an opportunity for educators and tutors to help school children navigate through online learning.

Have you gone to the gym lately? Probably not. With gyms and fitness centers closed, there is a growing need for trainers, wellness coaches and nutritionists. And let’s not forget the glue that will keep our networks and systems humming — remote tech support workers and troubleshooters.

Even in these very difficult times, opportunities to create a new business are present.

DBA vs. LLC for Your Remote Business

Two options for remote workers establishing a business are forming a limited liability company (LLC) or registering as a DBA , which stands for “Doing Business As.” To better understand the difference between these two options, let’s first go over the basics.

DBA — "Doing Business As"

Also referred to as a fictitious name or assumed business name, a DBA allows a business owner to operate under a name that is different from their own. Let’s take a look at the following example that will reference a popular television show Better Call Saul .

James Morgan McGill is a lawyer who wants to do business under an alias and decides to register as “Saul Goodman.” The name is catchy, easy to remember and is a play on the phrase “It’s all good, man.” Filing for a DBA in the state of New Mexico was easy and the process was completed in a matter of minutes...at least on television. In reality, applying for a DBA can vary from state to state, but overall, the following steps apply:

- Visit your state government websites (Secretary of State).

- Download and complete the relevant forms.

- Pay the fee, which can vary anywhere between $5 (Iowa) and $154 (Illinois).

- If your business is operating in multiple states, you will need to apply for a DBA in each state.

Limited Liability Company (LLC)

LLCs are state recognized entities that provide business owners with limited liability protection separating business assets from personal assets. So if money is owed and there is a lawsuit, there's a separation between the business assets and the owner’s personal assets.

Once an LLC is created, you will need to use the name of the LLC in all business dealings and transactions, from establishing bank accounts to filing forms and documents. If your LLC wants to conduct business under another name, you will need to go through the process of filing for a DBA. Steps needed when applying for an LLC include:

- Decide on your business name .

- Make sure that no one else is using that same name as an LLC.

- Visit state government websites (Secretary of State or Division of Corporations).

- Download, complete and return your forms, including “Articles of Organization.”

- Pay the fee, which can vary by state .

- Designate a Registered Agent .

- Complete publication requirement (depends on the state).

- Obtain necessary permits and licenses, including state certificate, required to conduct business.

- Establish a bank account for your LLC.

Filing as a DBA

Pros

- The filing process is not as complicated or as costly as setting up an LLC.

- It is ideal for a sole proprietor.

- It avoids using your real name.

- It allows you to create a catchy, more memorable name for your business. (Remember Saul Goodman!)

- It can have you set up and running your business in no time.

Cons

- A DBA does not form a business entity. Rather, it allows you to use a fictitious name for your business that differs from your actual name.

- Unlike the protections afforded to an LLC, your business assets and personal assets are not protected if you just file for a DBA.

- You cannot copyright or trademark your “fictitious” name or alias.

- You risk other people or businesses using your name or a variation of it.

- You are personally responsible for your debts.

Filing as an LLC

Pros

- It creates a separate business entity.

- It provides a way to protect — or limit — personal liability as a result of criminal, contractual or tort accountability.

- It can make your business come across as professional, qualified and legitimate, which may help attract clients and contracts.

- You can hire people and expand.

- An LLC is filed under your name and is afforded rights that a DBA does not have. (Remember the first two letters of LLC: limited liability!)

Cons

- An LLC is more costly to initiate and maintain.

- Having an LLC does not mean you have corporate status.

- It is recognized at the state level but not at the federal level. (If you form an LLC with another person, then you will be recognized on a federal level, but as a partnership.)

- You need to follow publication requirements.

- Filing for taxes can be more complicated, and LLCs are subject to self-employment taxes.

Weighing the Options

If you were recently downsized and would like to "set up shop" as soon as possible, a DBA would be the best option. Having a DBA will allow you to conduct and promote your business without the need to fill out and submit all the paperwork that's required for an LLC, including Articles of Organization.

An LLC works if you have the time and money to complete your filings. It's also key to remember that an LLC benefits you if you have personal assets that you want to protect should you ever face a lawsuit. On the other hand, if you are renting an apartment, paying a mortgage, leasing a car or do not own anything of substantial monetary value, than having an LLC may not be what you need at the moment, in which case, the choice would be to go for a DBA.

Whether it's establishing an LLC or moving forward with a DBA , Bizee will help guide you through the process and get your business off the ground and running. In these uncertain times, the best person to rely on is yourself, so if you have a dream or a plan to set up your own business and become your own boss, now is the time to get the ball rolling!