T he U.S. food truck industry has been booming in recent years, and the market is expected to grow to more than $2 billion by 2030. But as countless entrepreneurs have discovered, starting a successful food truck business isn't as easy as decking out a truck and hitting the gas — especially if you plan to cross state lines.

Here, we're giving you a full breakdown of multi-state food truck licenses, permits, state regulations, and incorporation rules, complete with tips from industry experts. By the end, you'll know everything you need to run a thriving, multi-state food truck business.

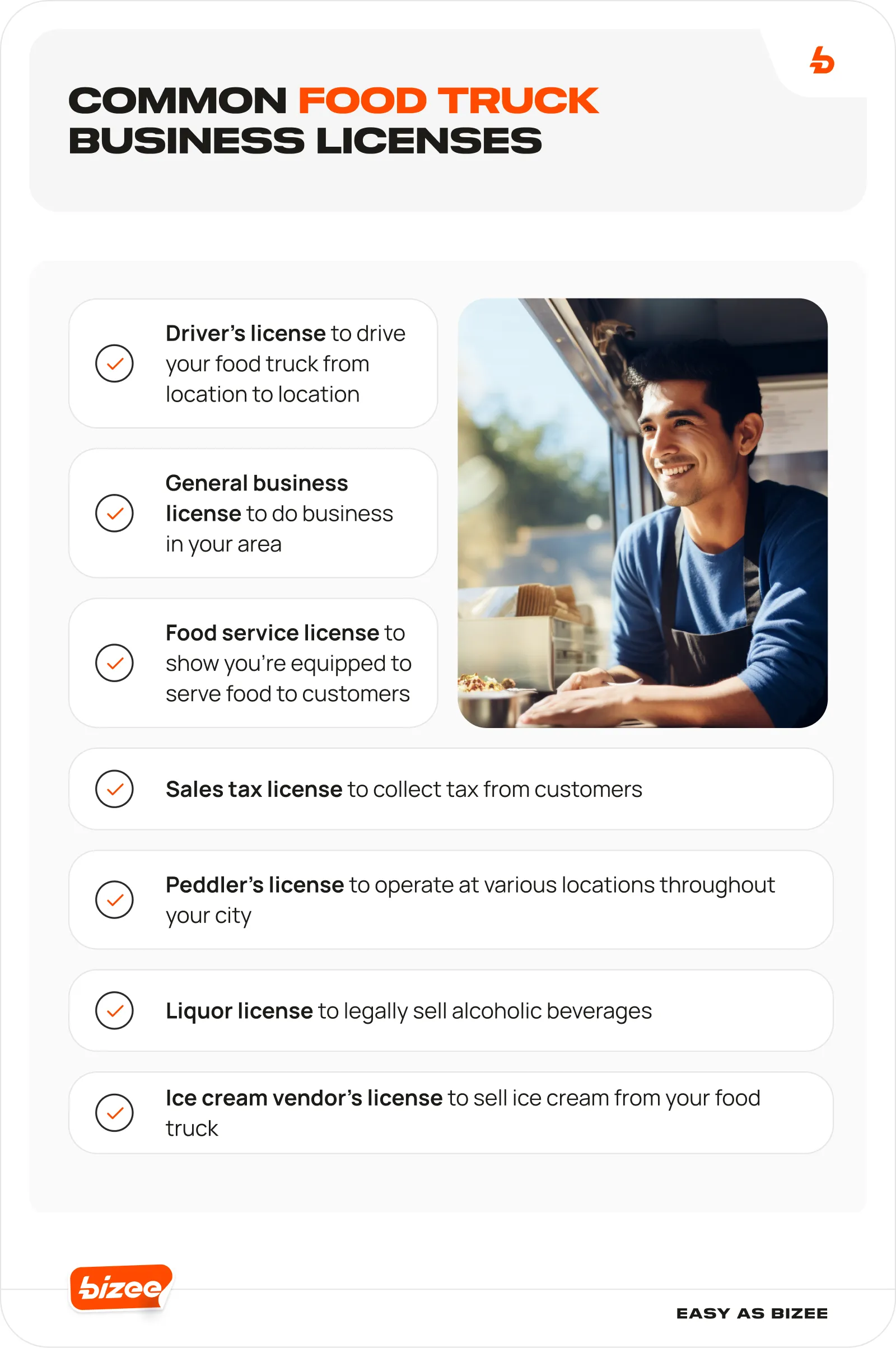

Food Truck Licenses

Operating a food truck requires getting one or more business licenses . Brian Meiggs, founder of Gigs Done Right , told us that "regulations vary by location, so research the requirements in your area." And don't forget the first step to getting any of these licenses: obtaining an EIN; it's required before applying.

Need help determining which licenses your food truck needs? Use our Business License Search Tool to get a list of licenses you may need.

Driver's License

A food truck is a motor vehicle, so you'll need to have an up-to-date driver's license to operate it. If your food truck's weight exceeds 26,000 pounds, you'll need a commercial driver's license (CDL). Most food trucks don't weigh that much, but it's something to keep in mind while truck shopping.

General Business License

Most states don't require a state-level general business license, but many counties, cities, and towns do. Such a license only allows you to conduct business in the location you obtained it from, so if you plan to take your food truck to multiple towns, you may have to obtain a license from each one.

Food Service License

Since your food truck is effectively a mobile restaurant, you must obtain a food service license from the counties and/or cities in which you operate. The process of obtaining a food service license depends on your local government's regulations, but it typically involves filling out an application and passing an inspection.

Sales Tax License

Many cities, counties, and states require retail establishments (including food trucks) to obtain a sales tax license, also known as a seller's permit. This license allows you to collect sales tax from customers and pass it on to the appropriate government agency, such as your state's Department of Revenue.

Peddler's License

In some areas, food trucks must obtain a specific type of license called a peddler's license. This allows food truck merchants to operate at various locations throughout the city or county instead of just one location as a restaurant would.

Liquor License

If you plan on selling alcoholic beverages or alcohol-infused food from your food truck, you'll need to obtain a liquor license from the states and/or local governments where you conduct business. This may be impossible in states where food trucks simply aren't allowed to sell alcohol, but many states will allow you to obtain a permanent or temporary liquor license for your food truck.

Ice Cream Vendor's License

Got ice cream on the menu? Your city or county may require your food truck to obtain a separate ice cream vendor's license in addition to its food service license.

Permits You’ll Need to Operate

Food truck regulations don't stop with food truck licenses. You may also require one or all of the following permits:

Fire Safety Permit

Food trucks often contain generators, explosive gas, and open flames in a small, confined area, making them susceptible to fires and explosions. That's why many locations require food truck owners to obtain fire safety permits from their city or county fire department. Even if your area doesn't have strict fire permitting requirements for food trucks, you can keep yourself, your business, and your employees safe by learning more about food truck fire safety .

Employee Health Permit

Also known as a food handler's permit, an employee health permit proves that your employees are trained to safely handle and store food. You and your team may be able to obtain permits via online training or by attending an in-person class.

Parking Permit

Many cities and counties have strict food truck regulations about parking. In Denver, for instance, food trucks cannot park within 300 feet of a park, within 20 feet of an intersection, or anywhere in the city's Central Business District. And even in areas where they can park, they typically need to obtain zoning permits (i.e., parking permits) to legally do so.

These types of regulations are common, and some cities even prohibit food trucks from parking near brick-and-mortar restaurants. So before choosing a place to hunker down with your food truck, make sure to do your research on local parking permit requirements.

Seafood Dealer's Permit

In states like Massachusetts, food trucks must have a seafood dealer's permit to legally sell fish, lobsters, and other types of seafood.

Certifications + Food Truck Laws

In addition to the licenses and permits listed above, you also must obtain at least some of the following certifications and documents:

Truck Registration and Insurance

Food trucks must be registered and insured just like any other road-legal vehicle, so expect to make a trip or two to the DMV before hitting the streets. Why? Shawn Hill, owner and pitmaster of The Grilling Dad , explains that getting insured "will shield you from any mishaps or injuries sustained while driving your truck."

Food Manager Certificate

This certificate is the manager-specific version of the employee health permit mentioned above. So even if your food truck doesn't have employees, you may still need to obtain a food manager certificate for yourself.

Commissary Letter of Agreement

Some states require food trucks to use commissary kitchens (i.e., rented commercial kitchens) to store and prepare food. To prove you're using a properly licensed commissary kitchen and not your home kitchen, you may need to provide a letter of agreement between you and the commissary kitchen.

Regular Inspections

Not only will your food truck be inspected before receiving its food service license for the first time, but it will also be subject to regular health and safety inspections. It's critical that you always follow food safety rules so you're never caught off-guard down the road.

Foreign Qualification Certificate

To operate your food truck in a state other than the one where you formed your business, you'll need to obtain a foreign qualification certificate, typically known as a Certificate of Authority.

Ongoing Legal Changes

Food trucks are a relatively new business type, so food truck regulations are constantly evolving. In some cities, food truck laws are changed on a yearly basis, so it's imperative that you stay up-to-date on your area's rules.

Consider Your Food Truck Location

Before gathering any of the permits, licenses, or certificates listed above, consider your food truck's location (or locations if you plan on operating in multiple cities, countries, or states).

Let's say you operate your food truck in your own town, but you know there's a lively college town 15 miles away. Before you can drive over there on busy weekends, you must fully satisfy the licensing and permitting requirements of both town districts.

Incorporate Your Food Truck in Multiple States

If you're located near a state border, you may want to take your food truck business across state lines. Before crossing over, make sure to thoroughly research the licensing and permitting requirements of the state, county, and city where you'll be selling food.

For instance, consider that California has no state-level business license, but its neighboring state Nevada does. If you start your food truck business in California but want to expand to Nevada, you'll need to obtain a Nevada business license along with the licenses and permits required by the Nevada cities and counties in which you'll be operating.

Beyond licenses, permits, and certifications, remember that doing business in a state other than the one your company was formed in requires you to register your business in the new state through foreign qualification. You'll need to ensure your business name is available in the new state, select a Registered Agent, and complete the state's foreign qualification paperwork.

How to Fund a Food Truck Business

Beyond licenses, permits, and certifications, food trucks entail plenty of other costs. In general, you can expect to pay for most or all of the following items:

- Food truck: On average, a new truck costs between $50,000 and $175,000, while a used truck costs between $30,000 and $70,000.

- Equipment: Even if your truck is already outfitted with all the electrical work, appliances, gas, and plumbing necessary to cook food, you'll still need to purchase commercial cooking tools and storage containers. This can cost anywhere from a couple of hundred dollars to several thousand, depending on what you need.

- Vinyl wrap: Many food truck owners brand and decorate their trucks with custom vinyl wrap, which typically costs between $2,500 to $6,000, depending on the size and complexity of the design.

- Commissary kitchen rent: Commercial kitchens usually charge anywhere from $15 to $40 hourly or $250 to thousands of dollars monthly for their use.

- Daytime parking: As explained above, food trucks may need to pay a flat or percentage-based fee to park in certain locations.

- Overnight parking: If you don't have the space to park your food truck at your home, you'll need to pay for an overnight parking spot. In most cities, this can cost anywhere from under $100 to about $1,000 per month, depending on whether the parking spot offers security, climate control, protection from the elements, or other features. A private lot may even charge a certain percentage of your daily sales.

- Modern point of sale (POS) system: Many customers prefer to pay (and tip) with a card rather than cash. To accommodate them, you'll need to have a modern POS system such as Square. Brad Anderson, Executive Director of Fruition , says that a food truck's POS system "should function like a well-oiled machine, with a QR code menu for ordering and a card reader at the front to receive payments and tips with ease."

- Employee wages: If you hire employees to help you cook, clean, or run the register, you'll need to pay them accordingly.

With all these expenses in mind, how can you finance your food truck business from the beginning? Luckily, you don't have to rely solely on your personal savings. Instead, you can turn to these sources:

- Business credit cards for startups

- Business lines of credit

- Business loans for startups

- Grants like Bizee's Entrepreneur Grant

- Loans from friends and family

- Venture capitalist funding

Pros and Cons of Operating a Food Truck

As with any other business, running a food truck comes with a unique set of pros and cons.

What Are the Pros of Having a Food Truck?

The benefits of owning and operating a food truck are numerous:

- Costs less than a restaurant: Buying a food truck is typically significantly cheaper than buying a brick-and-mortar restaurant. In the same vein, food trucks require less equipment and food to operate than restaurants.

- Mobility: You can take the food truck to your customers instead of trying to attract customers to one permanent location.

- Built-in advertising: With an appealing vinyl wrap, your food truck can serve as its own billboard.

- Culinary freedom: Food trucks offer total culinary freedom. "Consider focusing on a specific niche or cuisine," says Meiggs. "This can help you stand out in a crowded market and attract customers who are passionate about that type of cuisine. For example, you could specialize in vegan or gluten-free food or focus on a particular type of cuisine, such as Korean BBQ or Vietnamese street food."

- Stepping stone: If you dream of owning a restaurant but don't want to take on the risk of buying one outright, you can test the waters by starting a food truck business instead.

What Are the Cons of Having a Food Truck?

Despite the many benefits, owning a food truck business comes with downsides that you can prepare for by planning ahead:

- Food truck regulations: As we've reviewed above, obtaining all the necessary licenses, permits, and certifications needed to comply with your area's food truck regulations can be time-consuming and costly.

- Long hours: Professional restaurant consultant and President of Hospitality Works, Inc. Izzy Kharasch explains to us that "for the most part, the owner of the food truck is also its main/only employee. The work hours are very long because the owner is the prep person, the driver, the cook, and the cashier. Once all of that is done, the owner is the dishwasher as well."

- Weather: Since your customers will need to stand outside your truck to order food, a rain shower or snowstorm could hamper sales.

- Space limitations: Food trucks aren't nearly as big as a typical restaurant kitchen, so if you want to expand your storage space, you'll likely need to cut something to make room. "Because of limited space, it is not uncommon to run out of food when you have a crowd," says Kharasch. "The product must be simple to produce because a typical food truck can only get two people in the truck, so not a lot of room to produce complicated items."

- Truck repairs: Be prepared for your truck to break down, your generator to fail, or for any other mechanical mishaps to throw a wrench in your plans (and profits).

Food Truck FAQs

Can Food Trucks Travel State-to-State?

Food trucks can travel state-to-state as long as they adhere to the food truck regulations of each state, county, and city in which they do business.

Since regulations can quickly add up, we recommend starting with just one or two locations to start, preferably within the same state. Then, once you've recouped your startup costs and are in the swing of things, you can tackle the paperwork required to take your food truck to another state.

Can Food Trucks Drive Around Neighborhoods?

Depending on the city and county you're doing business in, you might be prohibited from setting up your food truck in a residential neighborhood. Regulations like this are typically put in place to protect residents from the crowds, trash, and noise food trucks may attract or create.

Why don't food trucks drive around neighborhoods the same way ice cream trucks do? It all comes down to logistics and safety. After all, ice cream trucks don't generally make their products inside the truck, while most food trucks do. They also do not contain hazardous kitchen equipment with explosive gas or open flames that are susceptible to fires and explosions.

Many food truck owners avoid driving around neighborhoods because of the inconvenience. Stopping for brief intervals requires constantly setting up and putting away kitchen equipment and ingredients — plus, there's always a risk of splashing hot oil or dropping dangerous kitchen tools with every speed bump.

Do Food Trucks Pay for Locations?

If you set up your food truck at an event, a food truck park, or a private parking lot, you'll likely have to pay "rent" to operate in that location.

How much will your food truck rent cost? It all depends on the location you're renting and who owns it. For instance, some event organizers charge food trucks a flat rate (typically $75+ per day). On the other hand, a food truck park might charge between $500-$1,000 a month. A private parking lot might charge you a certain percentage of daily sales (such as 10%).

To find out what you'll need to pay, contact the owners of prime parking locations in your area.

Keep on Trucking With Bizee's Expertise

Starting a multi-state food truck business isn't for the faint of heart, and it can involve parsing through a lot of red tape. Bizee has helped over 1 million entrepreneurs get their businesses off the ground, and we're ready to help you start your countrywide food truck empire.

That includes navigating multiple states' maze of business licenses, too. With our affordable and comprehensive Business License Research Package, finding out which licenses your food truck needs has never been more straightforward.

Business License Research Package: Find Permits for Legal Compliance.

Includes Free Registered Agent Service for a Full Year.

Order Your Package Today