B usiness trends have shifted drastically over the last four decades. In the 80s, nearly all business profit was generated by C Corporations. Today, that tide has turned, and now C Corps earn less than half of all business-generated income, according to the Brookings Institute. Roughly 95 percent of businesses in the U.S. have a pass-through entity (LLCs or S Corps), which exempts businesses from corporate tax and allows profits to flow through the owners’ individual tax returns.

While pass-through entities are generally favorable for small businesses, there are numerous reasons you might consider converting your S Corp to a C Corp. The good news is, if you’re already operating an S Corp, it’s relatively easy to make the change to a C Corp on your own.

Here, we’ll help you determine if converting your S Corp to a C Corp is right for your business, and the steps you can take to change your legal structure.

Why Convert from S Corp to C Corp?

C Corps aren’t right for every business, but there are situations that can make it desirable or even necessary. Here’s how to know when it’s time to make the switch:

Your Business Is in a Prolonged Growth Period

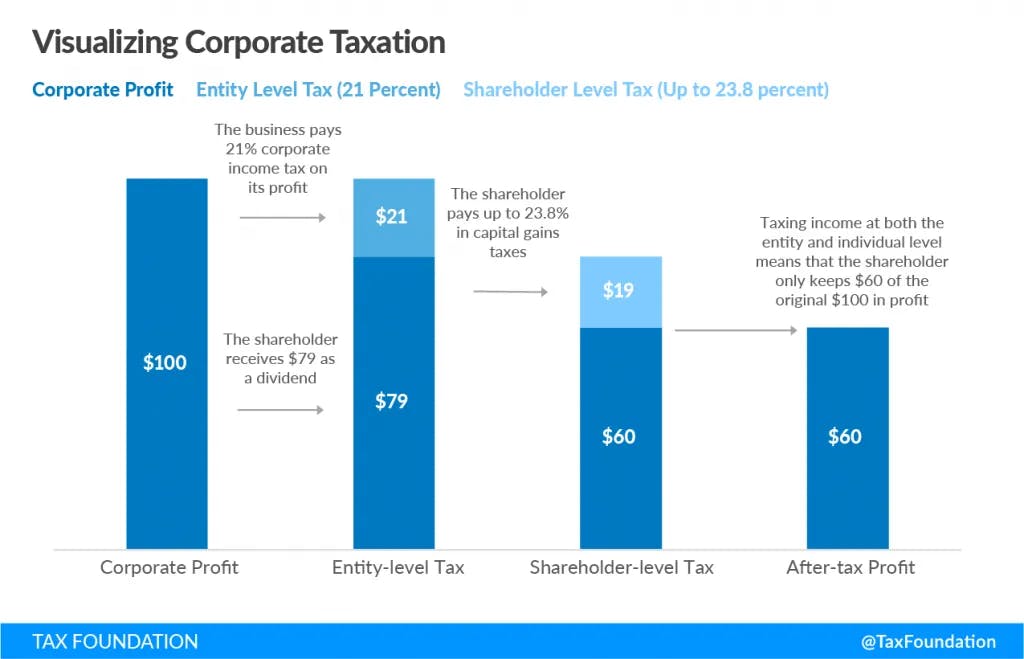

If your business is earning more than it has in the past, and you expect that trend to continue, you may benefit from restructuring to a C Corp. After the Tax Cuts & Jobs Act of 2017, the federal government lowered the corporate tax rate to a flat 21 percent. While many small businesses will find that the tax benefits of an S Corp election outweigh the corporate tax cut, businesses experiencing significant growth may opt to take advantage of the cut as a C Corp. If your business makes more than the S Corp tax deduction threshold of $326,000 for married couples and $163,300 for single filers, a C Corp could mean more savings.

You Want Your Company to Grow with Your Profits

S Corps benefit from the perks of pass-through taxation, but there are numerous restrictions on how they can operate. S Corps cannot have more than 100 shareholders, they do not permit foreign owners and stocks are restricted to a single class. If your S Corp is ready to grow beyond these limits, it might be time to transition to a C Corp.

Understanding the differences between an S Corp and a C Corp will help you make an educated decision on how to structure your business to maximize growth.

You Need More Investors, and You Want to Offer Them Greater Benefits

C Corps make it easier to grow your capital, mainly by allowing you to add as many shareholders as you like to the company. Additionally, the ability to offer different classes of stock to various investor groups makes the structure more appealing to those investors. C Corps also have more flexibility with deductions on a variety of benefits, from health coverage to life insurance and more.

How to Convert My S Corp to a C Corp

For all the DIYers out there, this will come as great news: converting your S Corp to a C Corp is a pretty simple process. In fact, before you elected your S Corp status, your business was already a C Corp. That’s because a C Corp is the default structure for all corporations. S Corps have to take the extra step of filing a tax election via form 2553 , which is used by the IRS to designate and tax your business as a pass-through entity. While you don’t need to take any specific action to reform your business as a C Corp, there are steps you’ll need to take to terminate your S Corp status, including:

Be certain of your decision: In most cases, once you terminate your S Corp election, you will have to wait five years before being eligible to file it again. Know before you take the next step that this is a long-term decision with lasting impact.

Don’t leave it to chance: You could simply wait for the IRS to terminate your S Corp election for you, which could happen if you violate any of the restrictions (e.g., adding more than 100 shareholders or a foreign owner). However, that could come with significant consequences come tax time, so it’s best you beat the IRS to the punch.

Revoke your S Corp status: Once you’re certain this is the right choice for your business, you can begin the process of terminating your S Corp election. It’s as easy as writing a letter to your area IRS offices and informing them of the change to your business. Here’s the breakdown of how to revoke your S Corp status:

- Title your letter: “Revocation of S Corporation Election.”

- Be sure the letter identifies the company’s name, tax ID number and the number of shares.

- Include the signature of the person authorized to sign the business’s tax returns (typically the president).

- Attach a statement of consent, noting that a majority of shareholders approve the decision to revoke S Corp election.

Schedule wisely: You can convert to a C Corp at any time, but when you do it may have tax implications. If you want your C Corp to take effect at the start of your tax year, you’ll need to submit your S Corp termination letter by the 15th day of the third month of that tax year. If your letter is received after that date, your S Corp status will remain in place until the following tax year.

Once the IRS receives your letter and terminates your S Corp election — congratulations — you’re a C Corp!

What’s Next for My C Corp?

Once your S Corporation election is revoked, your business may continue to operate in much the same way as before. However, you now have new opportunities for growth. Here’s how to take the next step in running your C Corp:

Make a plan: Though it’s likely you already had a business plan before forming your S Corporation, it’s time to revisit it and make a strategy to grow your business as a C Corp.

Start to expand: Now that you have the opportunity, you can add as many shareholders as you like to your C Corp and bring on foreign owners and investors. Put together a strategy to find and pitch to potential investors to get the capital you need to level up your business.

Don’t DIY your taxes: Converting your S Corp to a C Corp was a pretty painless process, and you might feel you can handle any business-related undertaking. You can, of course, but you need the right help. Converting to a C Corp changes your tax requirements significantly, and it isn’t something you want to deal with on your own. Seek out a reputable and trusted CPA or accountant, and get help filing as a C Corp for the first time.

As a business owner, there are many parts of the process you can do on your own to reduce costs, make changes quickly and retain control over key business decisions. But you don’t have to go it totally alone. Bizee’s DIYer’s Guide can put you on the path to planning, launching and operating your business on your own…with a little help.