Services

Services

Services

Services

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

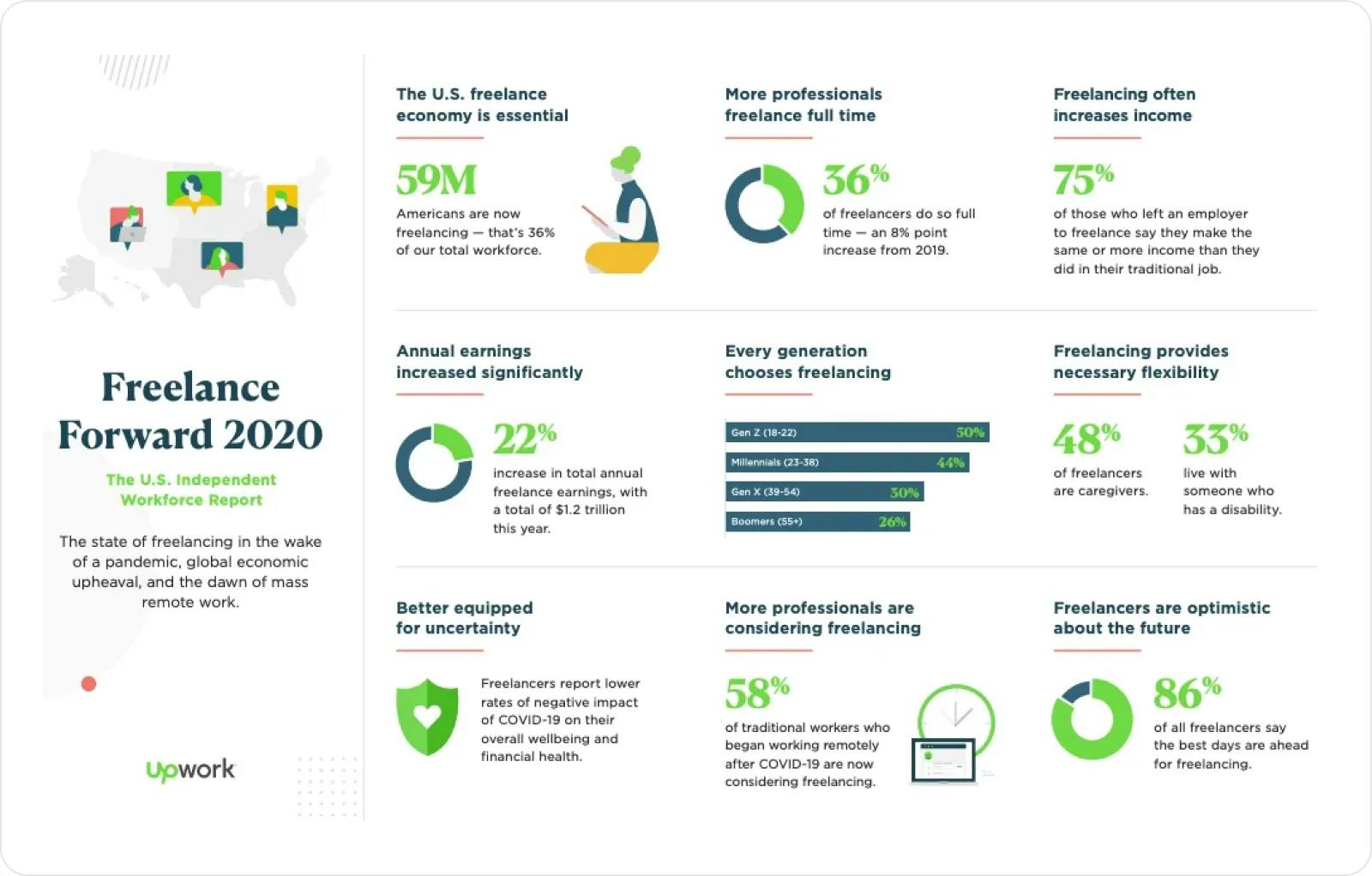

A mericans are doing more freelance work than ever before. According to a recent survey from Upwork, 59 million Americans have done some freelance work during 2020 and COVID-19. Many of these part-time freelancers say that they want to keep doing freelance work or independent contractor projects on the side into the future.

The Upwork survey, “Freelance Forward 2020,” also found that American freelancers increased their earnings by 22 percent in the past year, 58 percent of professionals who started working from home during COVID-19 are now considering freelancing and freelancers seem to be coping with the stress and challenges of the pandemic better than other workers. Freelancers report lower rates of COVID-19 having a negative impact on their financial health and overall well-being.

Source

Source

It seems that the economic uncertainty and job losses of 2020 have caused at least one optimistic result for American workers: more people are deciding to start a business. Recent data also showed that applications for Employer Identification Numbers (EINs) were up significantly compared to 2019. Whether it’s a side hustle, a part-time gig or an idea for a new full-time business, more Americans are using their skills and adaptability to earn money for themselves outside the confines of conventional full-time employment.

Even if you're not a full-time freelancer and even if you don't consider yourself a full-time business owner, you should still consider forming an LLC for your freelance work or side business . There are several good reasons why forming an LLC can help protect yourself and your business income.

When you form an LLC, you get an Employer ID Number (EIN) , which is a tax ID number for your business. This makes your business a legal entity that is separate from your identity as an individual person; that means your business can get its own bank account and build business credit under the business’s name.

Getting your own business bank account and business credit card can help you in many ways, such as making it easier to…

Even if you're doing part-time freelance work or side hustle projects, you still should keep business and personal finances separate . Forming an LLC makes it clear to your clients that any work you are doing for them is being done as a business; it lets you sign contracts under your business’s name. In case there is a costly mistake, an accident causing injury or a lawsuit that occurs against your business as a result of your freelance work, your LLC can provide a “corporate shield” that protects your personal assets from a lawsuit.

In addition to forming an LLC, check out your options for business liability insurance . No matter what kind of freelance work you do or what kind of industry you’re in, you might need business liability insurance to protect yourself from the worst-case scenarios of being in business.

No matter what kind of freelance work you’re doing, whether it’s designing websites or mowing lawns, having an LLC as a legal business entity for your business can help make you look more “official” and professional in the eyes of your clients. Signing a contract under your business’s name, presenting a business card that has your LLC’s name on it or creating a professional website for your freelance business that has the name and image of a real company on it, instead of just your own individual name, can be an image-booster and inspiration.

If you do not form an LLC, it is still possible to do freelance work and earn money as a sole proprietor. However, being a sole proprietor might not be the best fit for your overall business needs and financial goals. For example, as a sole proprietor, you cannot get a business bank account; any income earned will have to go into your personal bank account. You cannot build business credit, because you don’t have an actual legal entity for your business. You cannot separate your business and personal finances in case of a lawsuit, because you have no corporate shield.

Are you doing business as a freelancer in California? If so, you probably know about the California Assembly Bill 5 (AB5) law that has made it more complicated for California freelancers to do business. For example, freelance writers in California are no longer allowed to write more than 35 “content submissions” to any one media organization per year.

However, if you set up an LLC for your freelance business, you can be exempted from this limit. According to CNN , AB5 allows for a “business-to-business” exemption for freelance contractors that have set up LLCs for their businesses. This is another example of how being “official” in the eyes of the law can help your freelance business.

Not every part-time freelancer absolutely needs an LLC. If you are only doing a few simple projects for friends and family members on a cash basis, if you don’t think you would earn enough money from freelancing to pay for the costs of your state’s LLC filing fee or if you are only freelancing on a temporary basis until you can start a new full-time job and you never want to freelance again after that, then forming an LLC might not be necessary or worth the effort and expense.

However, if you want to make freelancing an ongoing part of your life, if you want to be able to claim a significant amount of business-related tax deductions on next year’s tax return and if you want to become a serious business that can potentially earn a good full-time income from your freelance work? Then forming an LLC for your freelance business might be a great start to a promising new career.

Ben Gran is a freelance writer from Des Moines, Iowa. Ben has written for Fortune 500 companies, the Governor of Iowa (who now serves as U.S. Secretary of Agriculture), the U.S. Secretary of the Navy, and many corporate clients. He writes about entrepreneurship, technology, food and other areas of great personal interest. Read more

Get Bizee Podcast

Join us as we celebrate entrepreneurship and tackle the very real issues of failure, fear and the psychology of success. Each episode is an adventure.