D un & Bradstreet (D&B) is a monitoring agency that provides in-depth information about businesses, large and small.

Lenders and other organizations use D&B data to make decisions about businesses like yours and rely on D&B information to identify risks, understand compliance and decide whether to lend to you and provide financing. That’s why it’s very helpful for all businesses to have a D&B profile and to do their best to keep it up to date and accurate.

One vital aspect of D&B data is the “Data Universal Numbering System,” or DUNS number. This is a unique identifier for each business that D&B holds data on. It means that D&B can link your business profile with the information they hold and is a reliable and accurate way to track an individual business’s performance.

This means it’s important to have a DUNS (or, in D&B parlance, D-U-N-S) number of your own. Fortunately, getting a DUNS number is fast, easy and free. Here’s our guide to obtaining a DUNS number for your business.

What DUNS Numbers Are Used For

According to D&B, “The DUNS Number is used as the starting point for any company's Live Business Identity, the most comprehensive and continually updated view of any company in the Data Cloud.” That’s a bit of a mouthful, so let’s break down what it actually means.

A DUNS number is a unique reference that D&B uses to assign data to a particular business. Other organizations can then use this DUNS number to lookup data, make inquiries and use D&B services related to that business.

Credit Scoring and Financing Decisions

In practical terms, the most common use of a DUNS number is for credit scoring and lending decisions. The main service that D&B provides is as a credit monitoring service for business entities. It performs a similar function for businesses and lenders as Equifax, Experian or TransUnion does for personal loans.

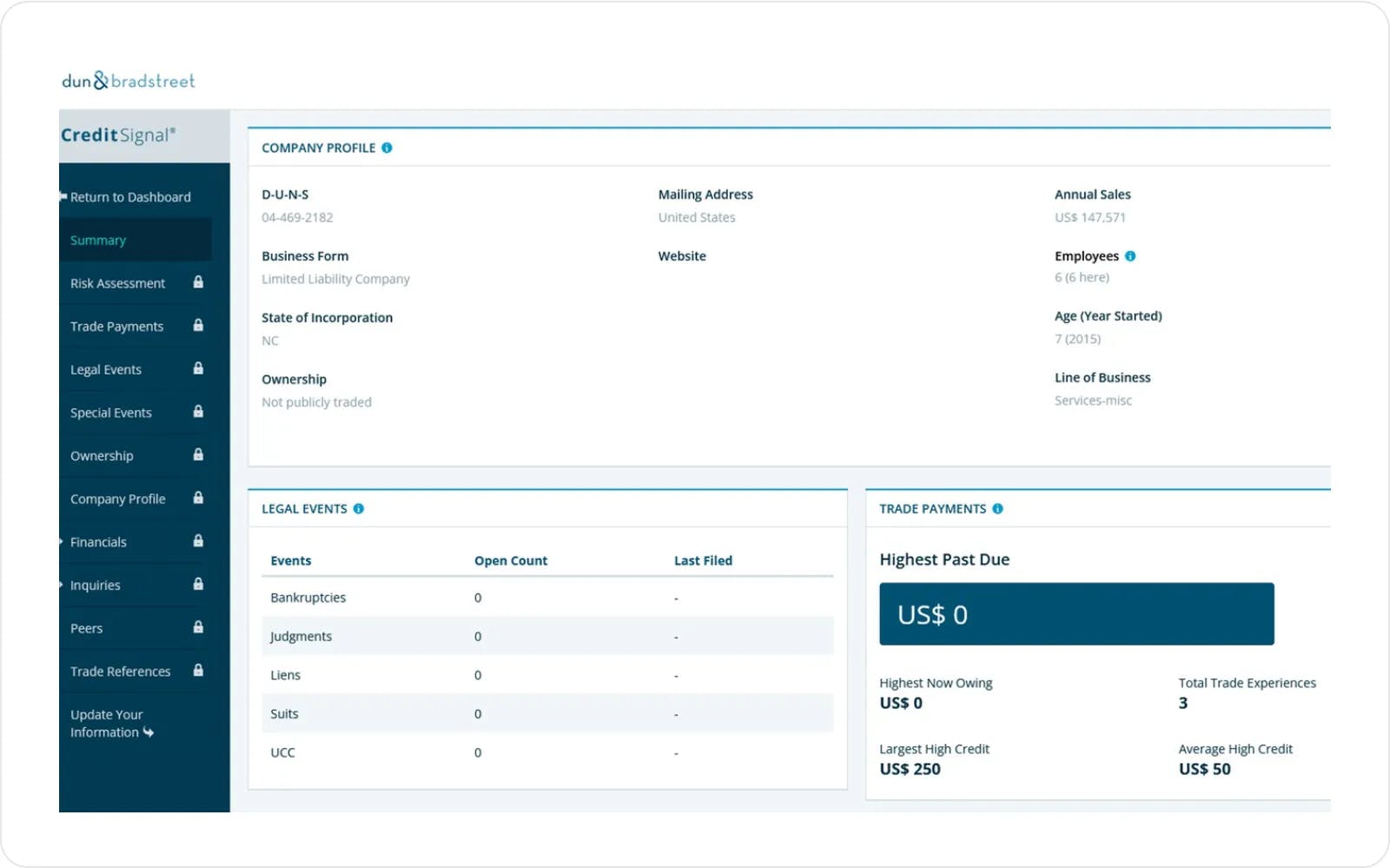

Just like personal credit, D&B will look at your payment and repayment history, credit usage, age of business loan accounts, judgments and liens and other factors. They will use this to create a credit report and score for your business, which is assigned to your DUNS number. A higher credit score means you’re more likely to get a loan and that it will have better terms and lower interest rates.

For new small businesses, lenders are more likely to use the business owner’s personal credit score, rather than a DUNS number, to decide whether to lend money. But for larger and more established businesses, the D&B scoring combined with a DUNS number can be an important part of getting business financing.

A DUNS number is often a requirement for obtaining grants, both from federal governments and other sources. Not having a DUNS number can prevent you from getting credit or from applying for certain grants or government contracts.

Potential Employees Investigating Businesses

It’s a tough labor market right now, and job applicants have a lot of choices on where they want to work. It’s becoming more common for candidates to review the financial health of a prospective employer, and a DUNS number makes it easier for them to do that.

Business Partners, Manufacturers and Suppliers Assessing Your Business Risk

Business relationships, supply chains and networks rely on a trusted relationship between all parties. Potential business partners can look up your payment history, potential risks and other information with a DUNS number to reassure themselves that they want to do business with you.

This can be even more important if you want to provide products or services to government entities or internationally. Not having a DUNS number might prevent potential partners from doing business with you.

How to Obtain a DUNS Number for Your Business

The only way to get a DUNS number is through the Dun & Bradstreet website. Here’s what you need to do.

1. Visit the D&B Website and Select “Get a D-U-N-S Number”

You can learn more about DUNS numbers from this article. When you’re ready to apply for one, simply select “Get a D-U-N-S Number” from that page, the top navigation or this link.

2. Choose Why You Want a DUNS Number

The first part of the D&B signup process will ask your primary reason for getting a DUNS number. Review the answers in the dropdown and choose the one that applies best to you.

3. Enter Some Basic Business Information

Next, you’ll need to enter your legal business name, address, state, country and phone number. D&B will then look up your business to see if you already have a DUNS number. If you don’t, you can then apply for a new one.

4. Add Further Information About Your Business

D&B will request further information to verify your business identity. This may include:

- The name of the CEO or business owner

- The legal structure or type of business (LLC, corporation, partnership, etc.)

- The year your business entity was created

- Your primary line of business

- Your total number of full- and part-time employees

5. Wait for D&B to Review Your Information and Provide a DUNS number

Once you’ve entered all of the necessary information, you can submit it to D&B. They will then review the data, and provided everything is on order, they will create and send you your DUNS number. There’s no cost for this, although you can certainly spend money on a D&B subscription if you think it would be useful to do so. D&B says that it can take up to 30 days to get your DUNS number, but in practice, it’s normally much quicker than that.

6. Review Your Company Information to Ensure It’s Accurate

Once you have a DUNS number, you can create and log in to a D&B account on their website. When you do, you can review your company information, financial history and other data to ensure it’s accurate. We recommend checking on your company information and history on a monthly basis and alerting D&B if you find any errors.

Your Questions About DUNS Numbers

How Do I Get a DUNS Number Immediately?

You can't get a DUNS number immediately. D&B says that it takes up to 30 days, but in practice, it's often much quicker than that. You can pay D&B for an expedited DUNS number service, which guarantees a number within five business days.

How Long Does It Take to Get a Free DUNS Number?

D&B state that it can take up to 30 days, but it's often much quicker, taking only a few business days.

We hope you’ve found this guide helpful. Because DUNS numbers are a widely used method of tracking business creditworthiness, it makes sense to apply for one now. That way, the next time you ask for a loan or start working with a new business partner, you’ll already have a number ready to go.

And when it comes to the financials of your business, getting a little help is always recommended. Check out Bizee's Accounting and Bookkeeping service. We can take care of all the details so you can run your business with ease.