Services

Services

Services

Services

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

M illions of Americans have a side business — commonly referred to as a side hustle — to either help make ends meet, transition from full-time employment to retirement or even fund a vacation, pay down debt or boost savings or retirement accounts. Some may even have their side hustle simply as a hobby that (bonus) makes money.

With about half of the working population having a side hustle, it begs the question of small business insurance. Do you need it? Small business insurance can be a smart move to not only protect your investment but to also secure your future from potential liabilities and losses that may put your side hustle and finances at risk.

There are many ways to go about acquiring insurance for your business. The trick is to find the right coverage for your needs that will also accommodate your side hustle business and even factor in plans for expansion and future growth. Here's what to know.

According to the IRS , “A business operates to make a profit. People engage in a hobby for sport or recreation, not to make a profit.” So if the intent is to make money, then you are running a business as a sole proprietor. And if you want to protect the business that you are building with your side hustle, having the right insurance coverage is an important consideration.

Working as a sole proprietor does not require you to register with the state, but you will need to file a Schedule C when it comes to tax time. This tax form, also known as Form 1040 is used to report income or loss in your side hustle. And when it comes to side hustles, most of them are recognized as sole proprietorships . Of course, there are benefits to registering your side hustle as an LLC as well.

Many side hustles will require startup costs, but the good news is that these can be tax-deductible and used to your benefit at tax time. The same applies to losses, which can offset your income and lessen your tax burden. And don't neglect to add your business insurance premiums as a deduction!

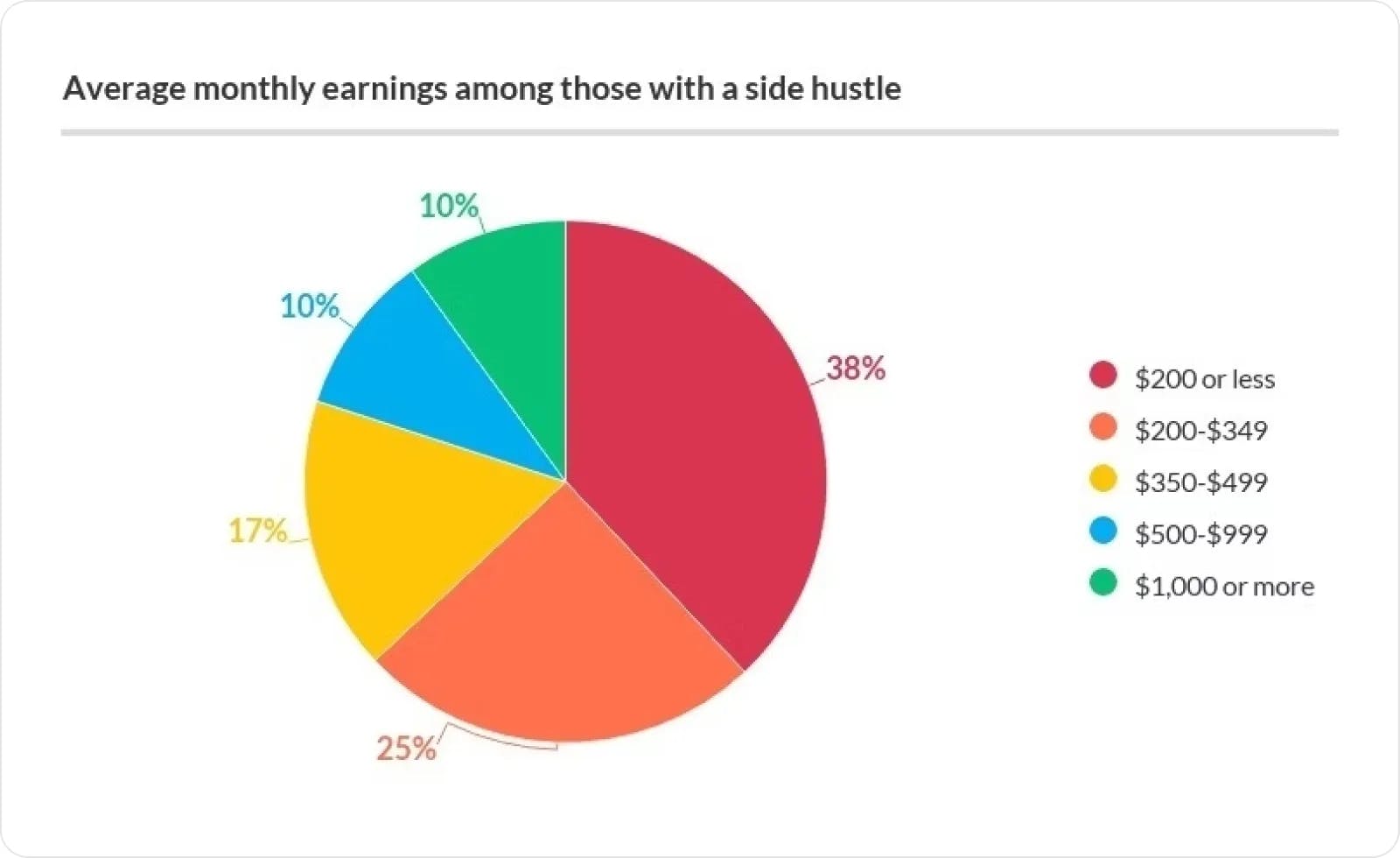

Most side hustles make a few hundred dollars a month. This, of course, depends on how much time and effort you put into the business and what you’re actually providing. For instance, a tutor or housesitter will tend to earn more than someone making ceramic ashtrays. So at what earnings threshold should you consider small business insurance?

Taking into account the average monthly income, a key consideration any budding entrepreneur will need to make is whether or not getting insurance is a viable move. Remember, the key purpose of having insurance is to protect you from financial loss as well as any liability directly related to your service or product. If your business is part of the upper 10 percent making $1,000 or more a month, then acquiring insurance for your side hustle should be explored.

Having insurance for your growing side hustle can protect your investment, including your equipment, inventory and even reputation when it comes to liability claims. Now it’s time to consider the next step of protecting that income, as well as the commitment you have put into your side business.

You'll also need to consider your personal assets, which are not protected in case of a lawsuit. Filing an LLC for your side hustle would provide liability protection. But if you haven't done that, or just want more coverage, business insurance is the way to go.

You may not be a million-dollar business (yet), but you’ve laid the foundations of your business and should consider the strategic importance of insurance.

Having business insurance will not shield you from a client slipping on your floor or a flood damaging your inventory or equipment, but it will provide monetary compensation to help you make up for the loss and get back to business.

Whether it’s an unintentional fault from your end or an overzealous client or customer looking to cash in, having professional liability insurance, also called errors and omission insurance, will provide coverage to help you defend yourself, as well as the reputation of your business. It will also provide you with a means to address the allegations — whether alleged or intentional — and work on a resolution or settlement.

If you’re contemplating acquiring insurance for your side hustle, then it’s obvious that you have bigger plans for your business. This may include buying additional equipment, storage space or even a new car. These are just a few examples where there will need to be a significant investment made on your end. Insurance, including commercial property and vehicle, can help manage that risk and protect your big-ticket investments.

A large majority of side hustles begin as sole proprietorships. Unlike a Limited Liability Company (LLC) , which can protect a business owner’s personal assets, a sole proprietor's business assets are merged with their personal assets, including their home. So if there’s a lawsuit, a side hustler’s personal property and financial well being are also at risk.

In the last few years, it has become clear that anything could happen, from a pandemic to raging forest fires and other natural disasters, and even the threat of war. Add to that all the day-to-day worries and concerns in managing a business, and mitigating risk can really take a toll. Having insurance and knowing that you have some level of protection can help ease the stress and worry.

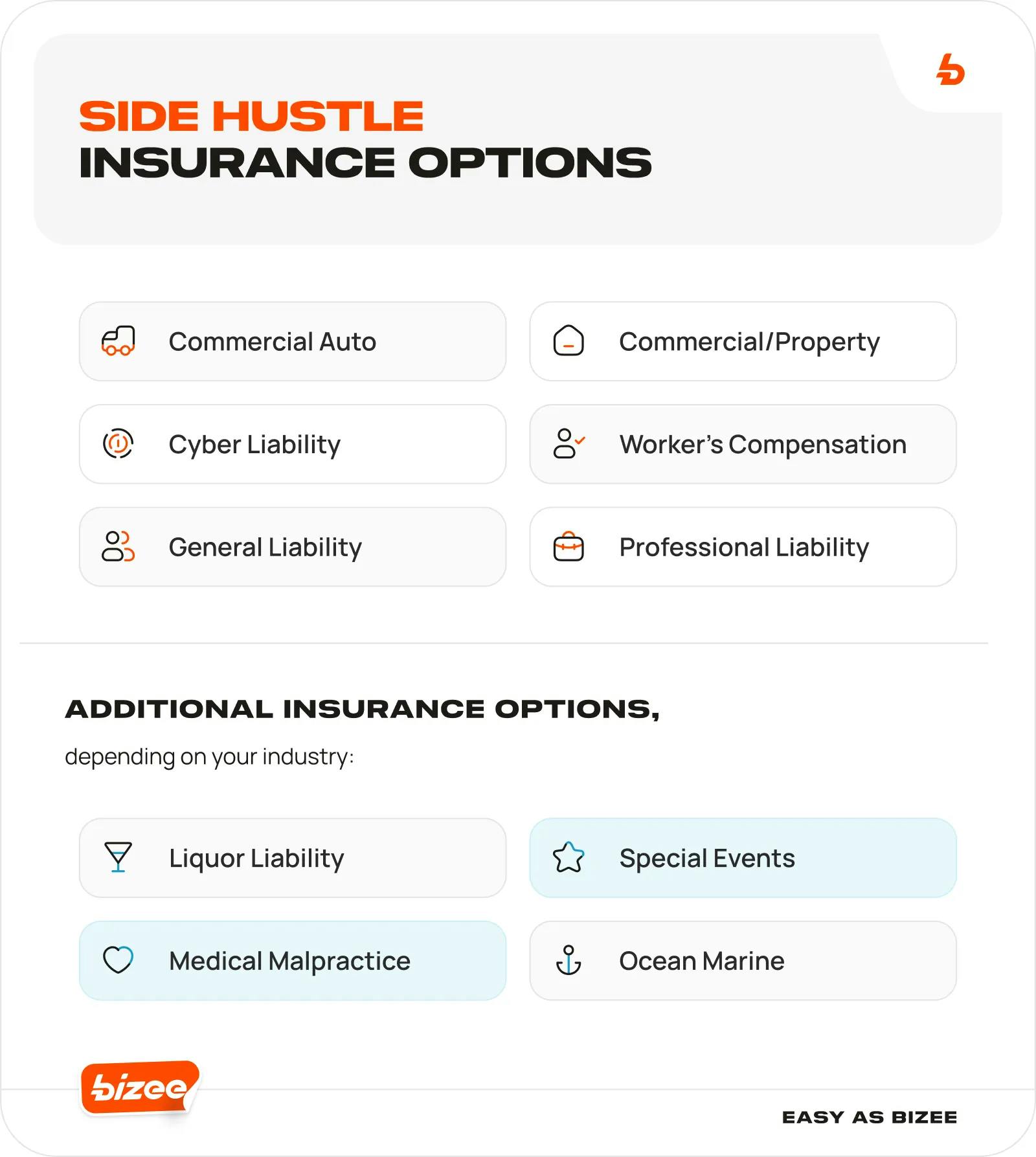

There are a number of options to consider when it comes to small business insurance, and policies can concentrate on different types and levels of coverage. Coverage and costs will also depend on the type of business that you are operating. Below is a breakdown of the main types of insurance coverage options to consider for your growing side hustle.

General Liability: This is the most common type of liability insurance that covers the key “general” needs and protections most companies will require. Bodily injury on your property (for example, a slip and fall) or damaged equipment and inventory are covered by this policy. And in case you are operating your business from home , do not assume that your homeowner’s insurance covers damages to your business. For that, you’ll need to review your homeowner’s policy.

Professional Liability: Also referred to as Errors and Omissions (E&O) Insurance, this is meant to protect you if your service is deemed as negligent by the client or customer. For example, if your side gig is teaching yoga classes and one of your clients suffers from a back issue or other physical injury, they can blame you for the instruction offered during the yoga class.

Workers' Compensation: Often referred to as “workers' comp ” for short, this coverage protects your employees if they suffer an injury or accident while on the job. It can also protect you from a lawsuit from your employee.

Commercial/Property: Covers physical property, whether it’s a garage or office space that's rented or owned. Make sure this plan covers your inventory and equipment!

Commercial Auto: Business auto insurance provides protection for vehicles associated with the business including collision, liability and medical coverage as a result of an accident.

Cyber Liability: Fairly recent in the offering of most insurance companies, this type of coverage protects a business if private data is “stolen” from the company or a business faces a cyberattack , extortion or loss of income due to digital issues and technical breakdown.

Additional insurance options can also be available to specific industries and include Liquor Liability, Medical Malpractice, Special Events, and even Ocean Marine, with the latter covering insurance for cargo freight and hull damage.

Having side hustle insurance comes at a cost, but the alternative of not having insurance can wipe out your dream of making your side gig your new full-time means of earning money.

Finding the right insurance can be time-consuming, but the steps below will help you get a leg up.

Step 1: Conduct an online search and consider recommendations from other side hustlers. Based on the list above, select the types of insurance that will be most beneficial to your business.

Step 2: Schedule an appointment with a local agent and go over your options, or use an online provider .

Step 3: Compare policies and prices. These can vary based on the coverage you choose. Working with an agent can help you determine the best amount of coverage you need.

Step 4: Choose an insurer and begin the application process.

Step 5: Review your quote(s).

Step 6: Make a payment.

Step 7: Take a deep breath and exhale. You're snow insured!

So we talked about the importance of insurance, including why your side hustle would need it and how to obtain it. Now to drive it all home, here are five side hustle businesses that can highly benefit from having insurance:

If you live in the suburbs, or anywhere with a patch of grass that needs cutting, then you know that there are three types of people. One type lets the grass grow wild and turn yellow. Another type wakes up early Saturday morning and starts mowing the lawn, pruning the hedges and adding the mulch. The third type is the person that hires someone to do the landscaping for them. So here are some examples of how things can go wrong with this business.

You love cooking and you started promoting your services as a caterer for small parties. Good for you! Now you’re making money doing something that you love. What can go wrong?

You’re spending your afternoons and weekends delivering groceries and restaurant meals or driving people around who request a ride. You’re driving a car and whizzing around town to meet deadlines. What can go wrong?

People like to go on vacation and they are lucky to have you to watch their canine family member for the weekend or for the week. You’re also making very good money in this side hustle. You can easily care for the dogs while you work at home during your 9-to-5 job, and you’re making a killing charging $40 a day per dog. That’s great...as long as you have insurance.

It’s great to help people get into shape, but if things go wrong, it can turn ugly. Here are a few scenarios that could affect your personal trainer business.

Finding the right insurance company to partner with is critical for understanding the policies and getting professional advice. You’ll also need to make sure that the rate covers your needs. Having access to an advisor on the other end can also be reassuring, knowing that your questions can be answered and your concerns addressed.

Take the next step by getting a free quote from The Hartford , an Bizee partner. Just fill out a quick online form and get your insurance quote in a matter of minutes. This "Insurance Capital of the World" has served over a million small businesses across industries, so it's no wonder why they have the best insurance policies your business can benefit from.

Peter Mavrikis is an author and editor with over 25 years of experience in publishing. He has worked as the Editorial Director for Barron’s Educational Series, as well as Kaplan Test Prep, where he ran the test prep, foreign language, and study guide. Read more

Get Bizee Podcast

Join us as we celebrate entrepreneurship and tackle the very real issues of failure, fear and the psychology of success. Each episode is an adventure.