Services

Services

Services

Services

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

T o get ready to file your business taxes , you’ll want to take note of the common tax deductions and credits in this list. If you find some that apply to your business, be sure to collect the necessary paperwork and submit it on your business taxes or hand it off to your accounting service.

Before we jump into the list of the most common tax deductions and credits, it’s important to understand just how a deduction or credit can impact your taxes. Your small business tax responsibilities are not as simple as filing your taxes as an individual.

As a small business owner, it's likely you file your taxes as a "pass-through" entity, meaning they’re passed on to your personal tax return. The only type of business that pays taxes directly to the IRS is a C Corp. If your business is a sole proprietorship, LLC, or S Corp, your taxes will pass through and show on your personal tax return.

In simple terms, your business pays taxes on your profit. Your profit is the amount left after you subtract your deductions from what your business earned. This means that the more deductions you take, the lower your business profit, which can affect the amount of tax you pay. This is why it’s critical to track your expenses and claim business deductions.

Tax deductions can also increase your tax refund. This can get a little complicated, so bear with us. A refund is a repayment from the IRS for withholding too much tax money. You might get a refund if you choose to withhold a higher-than-normal percentage of taxes from your paycheck or if you overpaid on your quarterly taxes.

Here's a common scenario: A business owner pays quarterly taxes on their expected income but then makes less money than planned. If this was the case, the owner would receive a refund for overpaying on quarterly taxes.

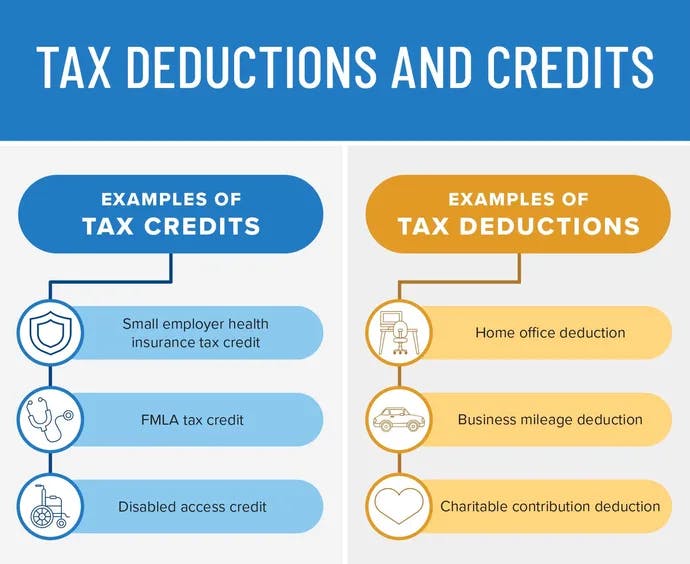

As a small business owner, there are a number of things you can deduct from your business income. These are called "tax deductions." In addition to tax deductions, there are "tax credits. A credit reduces the amount of income tax you owe.

Page is a freelance content marketing writer with experience writing about small business, the future of the workplace and health. She also operates a weekly email newsletter where she shares advice on living an authentic, intentional life. When not writing, you can find Page traveling, fostering older cats and working as a sexual assault advocate. Read more

Get Bizee Podcast

Join us as we celebrate entrepreneurship and tackle the very real issues of failure, fear and the psychology of success. Each episode is an adventure.