Why Start an IN Corporation?

The Indiana Economic Development Corporation offers a range of business incentives, giving corporations a step up in business. Your corporation may be able to take advantage of these incentives, provided it meets qualifying criteria.

For example, the Industrial Development Grant Fund provides assistance to municipalities and other eligible entities with off-site infrastructure improvements needed to serve the proposed project site.

For most entrepreneurs looking to establish a larger business, an IN incorporation may be the best choice. As a corporation, your business is able to buy and trade stock, and when it comes to excess profits, corporations offer more flexibility than a limited liability company (LLC). A corporation is allowed to pass income and losses to its shareholders, who report taxes on an individual tax return at ordinary levels.

Is an LLC Better Than a Corporation?

It all depends on what you want for your business. For smaller businesses, limited liability companies are usually a better option. An LLC is easier to set up and receives many of the same benefits as corporations, but with less regulation.

Learn more about forming an Indiana LLC so you can decide which business entity is right for you.

Benefits of Forming an Indiana C Corporation

It offers you numerous advantages, including but not limited to:

The strongest form of liability protection possible by insulating your personal assets and finances from business debts, obligations, damages, bankruptcy or other liabilities

Several options to create, buy, sell or transfer stock, including publicly

The ability to issue more than one type of stock

The ability to raise more funds by issuing more stock

The ability to sell stock to investors inside and outside the U.S.

Benefits of Forming an Indiana S Corporation

It offers several advantages similar to those provided by a C Corp including, but not limited to:

Options for creating, transferring and selling stock, though not as many as a C Corp

The capacity for up to 100 shareholders

Simpler rules than those that apply to C Corporations

Easy transfer of ownership simply by selling your stock

The possibility of saving money by allowing you to pay less self-employment tax

Start a Business in Indiana Checklist

To help you along the way, use our Starting a Business checklist to keep track of everything you need to do to get your business up and running.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.

On this page

How To Guide

Step 1: Choose a Unique Business Name and Complete a State Business Search

Every Indiana business must have a unique name that hasn't already been claimed by another business in the state. If you’re having trouble coming up with a name, try using our Business Name Generator to gather ideas. You'll need to follow a few naming rules, which you can read about in detail on the Indiana Corporation Names page.

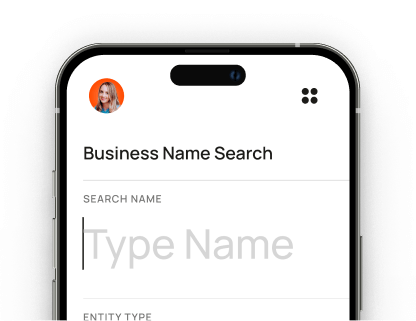

Once you’ve decided on a name, you’ll need to make sure it’s available in Indiana. To see whether another company in the state is using your desired business name, use our tool to do a Indiana entity search or you can carry out a name search on the state's website.

We Can Check Indiana Corporation Name Availability for You

Use Name Search Tool

Step 2: Provide an Official Business Address for your Corporation

All Indiana corporations must have a designated address. It could be the address of your residence (if you’re running the company from your home), a building where your office is located or any physical address of your choice. The address can be outside the state of Indiana and can be a P.O. Box.

You may also be able to use a virtual mailbox for your business address. Bizee can provide you with a Indiana virtual mailbox where we'll receive your mail, scan it and upload it for your online review. This can be especially helpful if you run a home-based business and don't want your home address published as part of your business public record.

Step 3: Assign a Registered Agent

Someone who receives official correspondence and is responsible for filing reports with the Indiana Secretary of State is known as a Registered Agent. Every Indiana corporation is required to have a Registered Agent.

You can fill this position yourself, assign another manager in your business or use a Registered Agent service. If your Registered Agent in Indiana is a person, they must have a physical street address in Indiana and must be present during business hours to receive important correspondence and documentation on behalf of your company. You'll appoint your Registered Agent when you file your Articles of Incorporation with the IN Secretary of State and formally create your corporation.

All of Bizee’s business formation packages include Registered Agent service. It’s free for the first year and just $119 per year after that. You can also access a digital dashboard to view any document we've received on your behalf.

Step 4: File Your Articles of Incorporation with the Indiana Secretary of State

Once you've gathered all the information for your corporation, you’ll need to file your Articles of Incorporation with the Secretary of State to officially create your business.

Your Articles of Incorporation should be filed online via the state's digital portal, or Bizee can file it on your behalf. The IN Corporation filing fee is $100.

You only need to file your Articles of Incorporation in Indiana once, but every two years after, you'll also need to file a biennial report with the Secretary of State in IN. Your biennial report can be filed online via the state's online portal. Bizee can remind you about this every two years, or we can do it for you if you have us handle the paperwork.

Let Bizee Handle All the IN Incorporation Paperwork for You for $0 + the State Fee

Incorporate Now for Free

What are the fees and requirements to incorporate in Indiana?

State Fee

$98

State Filling Time

3 Weeks

Expedited Filing Time

1 Business Day

Annual Report

Frequency

Biennially

Due Date

Last day of anniversary month of formation or qualification.

Filing Fee

$32

Step 5: Get an Employer Identification Number (EIN) from the Internal Revenue Service

You'll need an EIN to identify your business to the IRS. You will use this number for filing and paying taxes, submitting payroll information and payments for your employees and opening a business bank account. You can obtain one directly from the IRS, or Bizee can get one for you as part of the IN corporation creation process.

Step 6: Write Bylaws

A set of rules that govern how a corporation will be run, bylaws detail how many directors the corporation will have, whether the board of directors will have annual meetings and what the voting requirements will be, among other things.

Some states - including Indiana - legally require companies to create bylaws. You don't need to file your bylaws with the Secretary of State, simply keep them with your other business records at your corporation's principal address.

It's always a good idea to write and follow bylaws to protect your business from any future changes and events.

Types of IN Corporations

C Corporation

When you file to start a corporation, by default, it's a C Corp. This is the choice for large businesses that will trade shares in the stock market.An Indiana C Corporation will offer you several liability protections, but it will also be required to adhere to numerous strict rules and regulations. It will also likely have a substantial amount of administrative overhead, and won't enjoy as many tax advantages as other corporation types. Learn more about C Corporations.

S Corporation

Technically, an S Corporation isn't a business entity the way LLCs and C Corporations are. It's a tax filing status. An LLC or a C Corporation can be an S Corporation. It's just a matter of filing a form with the IRS. The main reason to file as an S Corp is to save money on self-employment taxes. To get an idea of how much money you might save, use our S Corp Tax Calculator. If you want your Indiana C Corporation to be treated as an Indiana S Corporation, file the IRS Election by a Small Business Corporation form, also known as Form 2553 or an S Corp Election form. Consult with your tax advisor or accountant to determine whether this is your best option.Learn more about S Corporations.Compare S Corp vs. C Corp to learn the benefits and drawbacks of both, and decide which one will best suit your needs.

Professional Corporation

Some states, including Indiana, allow certain occupations to form Professional Corporations and perform professional services. The Indiana Code, Title 23, Article 1.5, Chapter 1, IC 23-1.5-1-11 defines a Professional Service in Indiana as:

"... any type of service that may be legally performed only by:

Check with the Secretary of State to confirm whether your business should and can be a Professional Corporation.

Foreign Corporation

If your business operates in another state and you want to expand into Indiana — or vice versa — you’ll need to form a Foreign Corporation.

Nonprofit Corporation

Charitable organizations can incorporate as nonprofit corporations. This means all the profits they generate are donated to the organization supported by the charity, minus administrative costs. A nonprofit corporation is also exempt from federal and state taxes, allowing more of the profit to benefit the charity. Note: Everything in this guide applies to for-profit corporations, and mostly to C Corps and S Corps. Items listed as requirements for forming a corporation may or may not also apply to nonprofits.

Limited Liability Company

Depending on your personal circumstances and goals, or the kind of business you want to start, an LLC may be a better option for you. For example, if you want to run a small business on your own or with just a few employees, you may not need the options to buy and sell stock.

In this case, an Indiana LLC is usually a better option for a smaller business. It's easier to set up, but it still offers you certain advantages you'd get from a corporation. You can even have your LLC treated as an S Corporation for tax purposes to save you money.

Regardless of which direction you decide to go, we can help you with your Indiana business registration.

Learn more about limited liability companies.

Sole Proprietorship or Partnership

These are the simplest types of businesses to set up. That's because there's no real setup to do. If you don't choose to form a separate business entity, by default, you'll have either a sole proprietorship (just you) or a partnership (you and one or more other people). Neither of these options provide you with any special benefits or liability protections and can leave your personal assets vulnerable. For these reasons, we don't recommend them. Compare business entity types to decide which one is best for you.

Helpful Resources from the State of Indiana

More Information in This Guide

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.

.jpg&w=3840&q=75)