FAQ

Starting a business in Pennsylvania? Maybe you should get into mushrooms — no joke. Pennsylvania is leading mushroom production in the states where it reaches 425 million pounds annually which is valued at more than $330 million — just wild! Okay, so maybe you don't want to grow mushrooms, but when you're forming an LLC in the state of Pennsylvania, you'll likely have a lot of questions. We've gathered many of the most frequently asked questions to help you hit the ground running with your Pennsylvania LLC. From registering your company with the state of Pennsylvania, to business licenses and sales taxes, we’ve got you covered. We’ve answered these questions below and linked extensively to our guides, tools and other services, which makes everything streamlined and simple.

Incorporate Through Bizee for $0 + the Pennsylvania State Fee

And get a free Registered Agent for a year.

Incorporate Your Pennsylvania LLC Now

Is Your Business Name Available in Your State?

Find out using Bizee’s Business Name Search Tool.

Free Business Name Search

Trying to Come Up With a Creative Business Name?

Try Bizee’s Business Name Generator to brainstorm ideas.

Business Name Generator

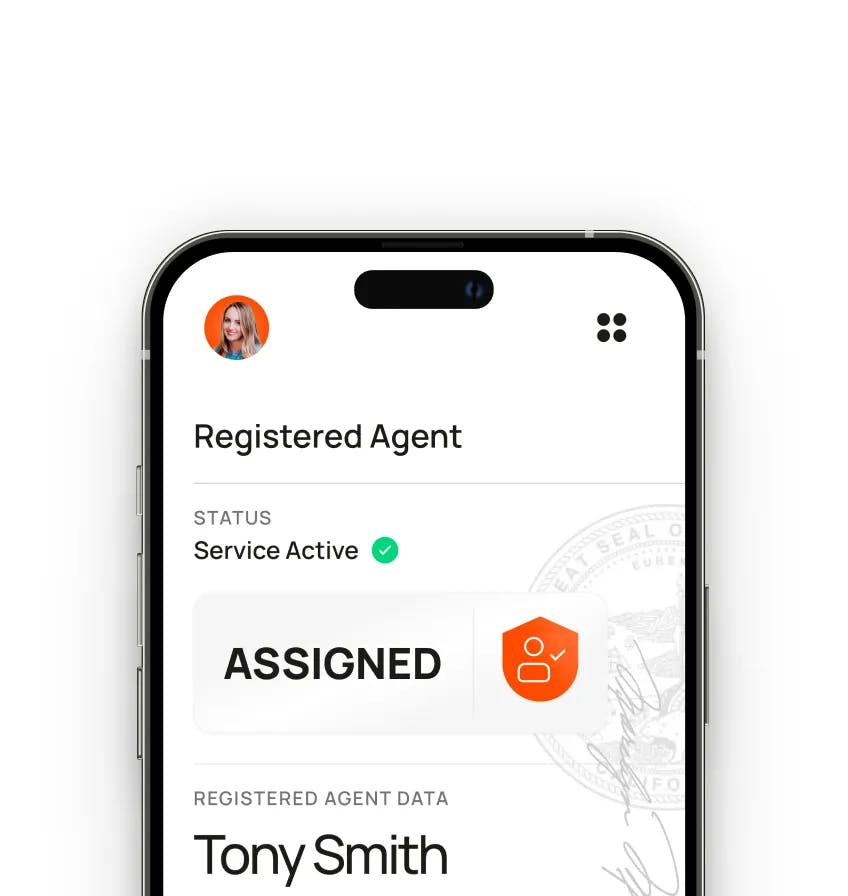

Have Bizee Act as Your Registered Agent for Only $119 a Year

Or get your first year free when you incorporate your business through us.

Registered Agent ServiceIncorporate Your Pennsylvania LLC Now

Need to Change Your Registered Agent?

Have Bizee file the paperwork for you

Change Of Registered Agent Service

We hope you’ve found this Pennsylvania LLC FAQ useful. If you’ve used our services and have a question that isn’t answered here, let us know and we’d be happy to help.

incorporate now

Launch your business with bizee

No Contracts. No Surprises. Only $0 + State Fee to Launch Your Business.